Ransomware Myths Busted: How Cyber Insurance Impacts Payments

Protecting Your Business: Cyber Insurance Against Ransomware

A staggering 72.7% of organisations globally fell victim to a ransomware attack in 2023, according to Statista. These attacks are not only becoming more frequent but also more costly. SC Media reports that the average cost of recovering from a ransomware attack in 2023 hit $1.82 million, a figure that notably excludes the ransom payment itself. This alarming trend underscores the critical importance of cyber insurance in today’s business strategy.

Ransomware: A Growing Threat to Global Business

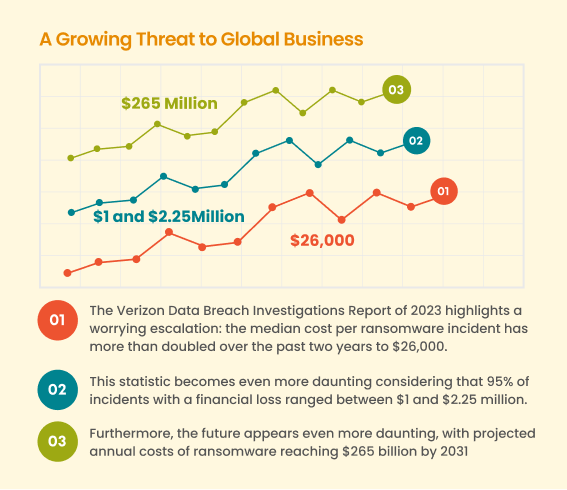

The Verizon Data Breach Investigations Report of 2023 highlights a worrying escalation: the median cost per ransomware incident has more than doubled over the past two years to $26,000.

This statistic becomes even more daunting considering that 95% of incidents with a financial loss ranged between $1 and $2.25 million.

Furthermore, the future appears even more daunting, with projected annual costs of ransomware reaching $265 billion by 2031. Beyond the staggering financial toll, businesses face downtime, operational disruptions, legal settlements, skyrocketing insurance costs, and the incalculable damage to trust from investors, clients, and employees.

The Indispensable Role of Cyber Insurance in Business

In the face of these threats, cyber insurance emerges as an indispensable shield. By offering a financial safety net, it allows businesses to recover from ransomware attacks without succumbing to financial ruin.

However, choosing the right cyber insurance policy demands careful consideration. It’s crucial to ensure that the coverage encompasses not just the direct costs of attacks but also accounts for the broader repercussions, including legal fees, notification costs, and even the ransom payments in some cases.

Crafting a Resilient Defense Against Ransomware

While cyber insurance is a critical component of a business’s defence strategy, it should be part of a broader, proactive approach to cybersecurity. Regular data backups, employee training on cyber threats, timely system updates, and the deployment of advanced security solutions form the bedrock of ransomware resilience.

These measures, coupled with a robust cyber insurance policy, can significantly mitigate the risk and impact of ransomware attacks.

Navigating the Future of Cyber Threats

As we look to the future, the evolution of cyber threats necessitates a dynamic response from businesses and insurers alike. The increasing specificity and sophistication of ransomware attacks will likely lead to more tailored cyber insurance solutions. These policies will need to adapt to the changing landscape, offering coverage that reflects the actual risks and potential damages businesses face.

Last words

The grim statistics on ransomware’s impact underline the necessity of cyber insurance in today’s digital world. As businesses navigate this challenging landscape, the right cyber insurance policy stands as a beacon of resilience, offering protection against the financial and reputational fallout of attacks. In an uncertain future, such insurance not only provides a crucial financial backstop but also signifies a commitment to safeguarding the very essence of a business in the digital age.

In this context, Mitigata sets itself apart by offering a comprehensive cyber solution that seamlessly integrates cyber insurance with cybersecurity measures. Our unique selling proposition lies in our holistic approach to protecting businesses, ensuring not just recovery from cyber threats but robust prevention against them, solidifying your business’s resilience in the digital domain.