Professional Indemnity Insurance vs. D&O Insurance

Cyber Incident Reporting for Businesses: Guide 2024

A Closer Look at the boAt Data Breach: Lessons Learned and Preventive Strategies

Safeguarding Schools: The Importance of Cyber Insurance in Education

Understanding Liability Protections in Cyber Insurance

Addressing Fraud Risks: Cyber Insurance for Social Engineering

“The only truly secure system is one that is powered off, cast in a block of concrete and sealed in a lead-lined room with armed guards – and even then I have my doubts.” This hyperbolic quote by Gene Spafford, a pioneer in the field of computing and network security, humorously underscores the pervasive threats in cyberspace. Among these, social engineering emerges as a distinctly human loophole in the digital security chain, exploiting not system vulnerabilities, but human ones.

Imagine a bustling startup, XYZ Corp, on the brink of a major breakthrough. One day, an email seemingly from the CEO asks the finance department to wire funds for a confidential acquisition. The email is convincing, complete with the CEO’s signature and company letterhead. No one questions it; the transfer goes through. Days later, the deception unravels. The CEO had made no such request.

The funds, and perhaps the future of XYZ Corp, vanished into the ether. This incident is not just a cautionary tale but a stark reality for many in today’s interconnected world, where social engineering frauds are increasingly sophisticated.

Social engineering, in essence, is the art of manipulating individuals into surrendering confidential information or performing actions that may result in a security breach. In the realm of cyber insurance, it represents a complex risk, intertwining human psychology with technological vulnerabilities.

As we delve deeper into the nuances of social engineering, real-world case studies, and the protective layer cyber insurance offers, remember the tale of XYZ Corp. It serves as a potent reminder of the fragility of trust in the digital age and the paramount importance of vigilance and protection in all its forms.

Understanding Social Engineering

At its core, social engineering is a sophisticated form of deception, aiming to manipulate individuals into divulging sensitive information or performing actions that compromise security. Unlike traditional hacking, which often relies on technical vulnerabilities, social engineering exploits the most unpredictable element of cybersecurity: the human psyche.

The Psychology Behind Social Engineering

Humans are naturally inclined to trust, a trait that social engineers skillfully exploit. These fraudsters play on emotions—fear, urgency, sympathy—to elicit actions or information that would typically be guarded. For instance, by impersonating authority figures or trusted entities, attackers create scenarios where the target feels compelled to comply.

Recent Statistics

The prevalence of social engineering attacks is alarming. According to the FBI’s 2021 Internet Crime Report, phishing and similar frauds topped the list of cybercrimes, with reported losses exceeding $4.2 billion in the United States alone. This staggering figure underscores the effectiveness of such tactics and the critical need for awareness and protection.

Real-World Case Studies of Social Engineering

To understand the threat landscape, let’s examine some real-world incidents:

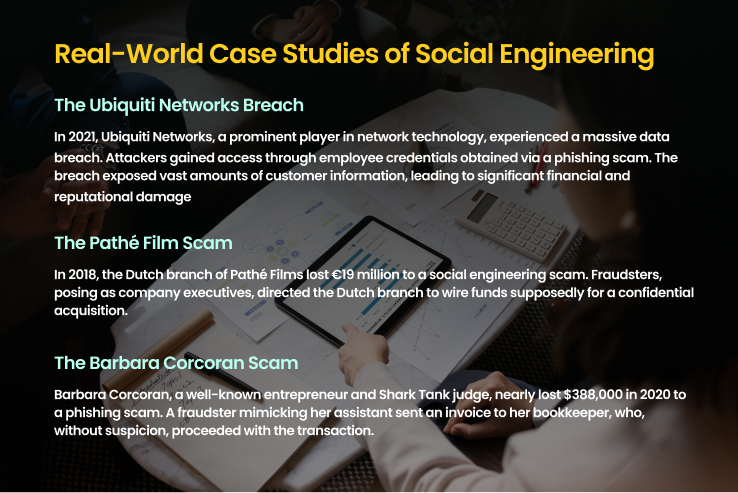

Case Study 1: The Ubiquiti Networks Breach

In 2021, Ubiquiti Networks, a prominent player in network technology, experienced a massive data breach. Attackers gained access through employee credentials obtained via a phishing scam. The breach exposed vast amounts of customer information, leading to significant financial and reputational damage.

Case Study 2: The Pathé Film Scam

In 2018, the Dutch branch of Pathé Films lost €19 million to a social engineering scam. Fraudsters, posing as company executives, directed the Dutch branch to wire funds supposedly for a confidential acquisition. The sophisticated deception went unnoticed until the damage was irreparable.

Case Study 3: The Barbara Corcoran Scam

Barbara Corcoran, a well-known entrepreneur and Shark Tank judge, nearly lost $388,000 in 2020 to a phishing scam. A fraudster mimicking her assistant sent an invoice to her bookkeeper, who, without suspicion, proceeded with the transaction. Vigilance and quick action recovered the funds, highlighting the importance of awareness and verification processes.

Cyber Insurance: A Safety Net

Cyber insurance is emerging as a critical component in the fight against social engineering. It offers a financial safety net for losses incurred due to cybercrimes, including social engineering attacks. Coverage typically includes direct financial losses and, in some policies, the costs associated with managing the aftermath of a breach, such as legal fees and customer notification.

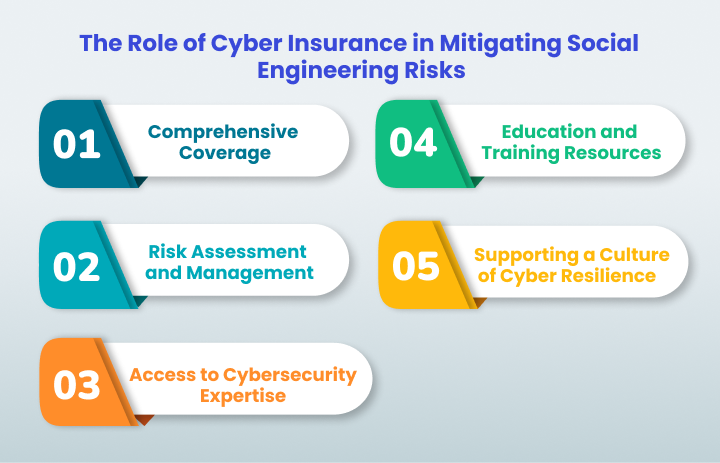

The Role of Cyber Insurance in Mitigating Social Engineering Risks

While cyber insurance does not prevent attacks, it can mitigate the financial impact, allowing businesses to recover more swiftly. It also often comes with resources to improve security postures, such as access to cybersecurity experts and education on emerging threats.

1. Comprehensive Coverage

Cyber insurance policies are designed to cover a range of incidents stemming from social engineering tactics, including phishing, spear-phishing, pretexting, and more. Coverage can extend to direct financial losses incurred through fraudulent transactions, ransom payments in the case of ransomware attacks, and even the costs associated with system downtimes. Moreover, these policies often cover the expenses related to legal fees, customer notification, and services such as credit monitoring for affected customers, thereby mitigating the broader financial and reputational impacts of an attack.

2. Risk Assessment and Management

Many cyber insurance providers offer risk assessment services as part of their policy packages. These assessments can identify vulnerabilities within an organisation’s digital and human elements, providing valuable insights into potential security gaps that could be exploited via social engineering. By understanding these vulnerabilities, businesses can take preemptive steps to fortify their defences, thus reducing the likelihood of a successful attack.

3. Access to Cybersecurity Expertise

Access to a network of cybersecurity experts is another significant benefit provided by cyber insurance policies. In the event of a social engineering attack, insurers can connect policyholders with professionals who specialise in cyber incident response, forensic analysis, and legal matters related to cyber law. This immediate access to expertise can drastically reduce the time and resources required to respond to and recover from an incident.

4. Education and Training Resources

Education is a critical component of cybersecurity, particularly in defending against social engineering attacks. Cyber insurance providers often furnish policyholders with training resources and programs designed to educate employees about the nature of social engineering threats and best practices for prevention. These training programs can include simulated phishing exercises, workshops, and e-learning modules, all aimed at heightening awareness and reducing the likelihood of employee error or oversight.

5. Supporting a Culture of Cyber Resilience

By integrating cyber insurance into their cybersecurity strategy, organisations can foster a culture of cyber resilience. This culture is underpinned by a comprehensive approach to risk management, which combines insurance protection with proactive cybersecurity measures. It acknowledges that while it may not be possible to prevent all attacks, minimising risk and ensuring rapid recovery are achievable goals. In this context, cyber insurance acts not just as a financial safety net but as a catalyst for adopting and maintaining strong cybersecurity practices.

Limitations of Cyber Insurance

It’s crucial to understand that cyber insurance does not cover all aspects of cyber risk. Policies often have exclusions and may not cover losses related to intellectual property theft or reputational damage. Thus, insurance should be one element of a comprehensive risk management strategy.

Integrating Cyber Insurance with Cybersecurity Measures

Cyber insurance and cybersecurity measures are most effective when integrated into a cohesive strategy. Businesses and individuals should adopt a layered defence approach, combining robust security practices with insurance coverage to safeguard against the multifaceted threats posed by social engineers.

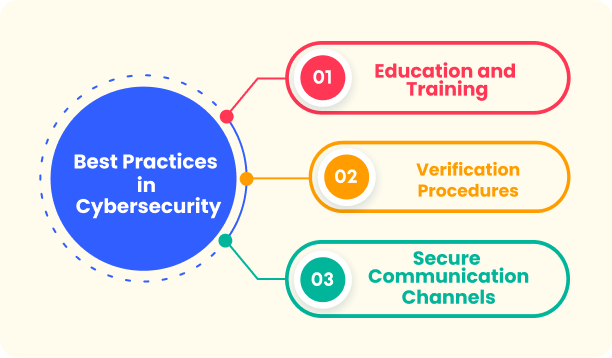

Best Practices in Cybersecurity

Implementing effective cybersecurity measures is paramount in preventing social engineering attacks. Key practices include:

- Education and Training: Regularly train employees to recognize and respond to phishing attempts and other social engineering tactics.

- Verification Procedures: Establish protocols for verifying requests, particularly those involving financial transactions or sensitive information.

- Secure Communication Channels: Use encrypted communication methods and authenticate emails to protect against interception and forgery.

Conclusion and Mitigation Strategies

The tales of XYZ Corp, Ubiquiti Networks, Pathé Films, and Barbara Corcoran serve as stark reminders of the vulnerabilities that social engineering exploits. In an era where trust can be both a strength and a weakness, understanding the nature of these threats and preparing accordingly is crucial.

Mitigation Strategies

To protect against social engineering:

- Cultivate Awareness: Regularly update teams on the latest social engineering tactics and encourage a culture of scepticism and verification.

- Invest in Cyber Insurance: Consider cyber insurance as part of a holistic risk management strategy, ensuring coverage aligns with potential exposures.

- Adopt Strong Cybersecurity Practices: Implement and maintain robust cybersecurity measures, including multi-factor authentication, encryption, and secure backups.

In the battle against social engineering, knowledge, preparedness, and resilience are our greatest allies. By integrating cyber insurance with comprehensive cybersecurity measures, businesses and individuals can fortify their defences, turning vulnerabilities into strengths.

Call to Action: Assess your current cybersecurity posture and explore how solutions like Mitigata can augment your defences. In the dynamic battlefield of cyber threats, where attackers continuously devise new methods to exploit vulnerabilities, a proactive and comprehensive approach is your best defence.

Protecting Your Business: Cyber Insurance Against Ransomware

A staggering 72.7% of organisations globally fell victim to a ransomware attack in 2023, according to Statista. These attacks are not only becoming more frequent but also more costly. SC Media reports that the average cost of recovering from a ransomware attack in 2023 hit $1.82 million, a figure that notably excludes the ransom payment itself. This alarming trend underscores the critical importance of cyber insurance in today’s business strategy.

Ransomware: A Growing Threat to Global Business

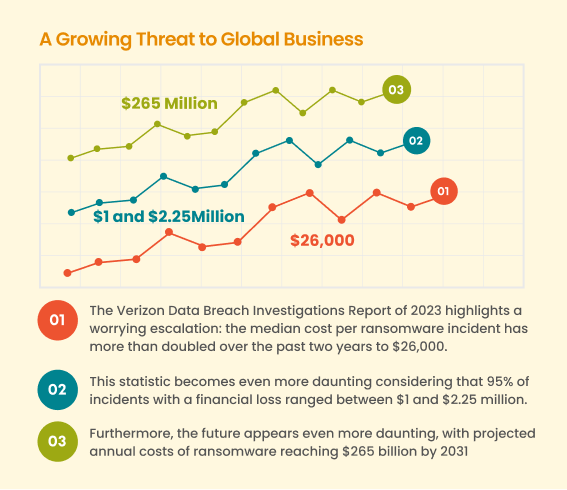

The Verizon Data Breach Investigations Report of 2023 highlights a worrying escalation: the median cost per ransomware incident has more than doubled over the past two years to $26,000.

This statistic becomes even more daunting considering that 95% of incidents with a financial loss ranged between $1 and $2.25 million.

Furthermore, the future appears even more daunting, with projected annual costs of ransomware reaching $265 billion by 2031. Beyond the staggering financial toll, businesses face downtime, operational disruptions, legal settlements, skyrocketing insurance costs, and the incalculable damage to trust from investors, clients, and employees.

The Indispensable Role of Cyber Insurance in Business

In the face of these threats, cyber insurance emerges as an indispensable shield. By offering a financial safety net, it allows businesses to recover from ransomware attacks without succumbing to financial ruin.

However, choosing the right cyber insurance policy demands careful consideration. It’s crucial to ensure that the coverage encompasses not just the direct costs of attacks but also accounts for the broader repercussions, including legal fees, notification costs, and even the ransom payments in some cases.

Crafting a Resilient Defense Against Ransomware

While cyber insurance is a critical component of a business’s defence strategy, it should be part of a broader, proactive approach to cybersecurity. Regular data backups, employee training on cyber threats, timely system updates, and the deployment of advanced security solutions form the bedrock of ransomware resilience.

These measures, coupled with a robust cyber insurance policy, can significantly mitigate the risk and impact of ransomware attacks.

Navigating the Future of Cyber Threats

As we look to the future, the evolution of cyber threats necessitates a dynamic response from businesses and insurers alike. The increasing specificity and sophistication of ransomware attacks will likely lead to more tailored cyber insurance solutions. These policies will need to adapt to the changing landscape, offering coverage that reflects the actual risks and potential damages businesses face.

Last words

The grim statistics on ransomware’s impact underline the necessity of cyber insurance in today’s digital world. As businesses navigate this challenging landscape, the right cyber insurance policy stands as a beacon of resilience, offering protection against the financial and reputational fallout of attacks. In an uncertain future, such insurance not only provides a crucial financial backstop but also signifies a commitment to safeguarding the very essence of a business in the digital age.

In this context, Mitigata sets itself apart by offering a comprehensive cyber solution that seamlessly integrates cyber insurance with cybersecurity measures. Our unique selling proposition lies in our holistic approach to protecting businesses, ensuring not just recovery from cyber threats but robust prevention against them, solidifying your business’s resilience in the digital domain.

Safeguarding Against Cyber Threats: Insurance for Financial Firms

Safeguarding Against Cyber Threats: Insurance for Financial Firms

“54% of organisations have experienced a cyberattack in the last 12 months, and 52% have observed an increase in cyberattacks compared to the previous year” (Varonis, 2023). This data not only underscores the relentless evolution and escalation of cyber threats but also highlights the pressing need for robust cyber defences and insurance strategies, particularly for financial firms which are increasingly in the crosshairs of cybercriminals.

In the shadowy corners of the internet, cyber threats evolve at a breakneck pace, constantly seeking new vulnerabilities to exploit. Financial firms, stewards of the world’s most sensitive data, find themselves at the epicentre of this digital battleground. The stakes? Not just financial assets, but the very trust upon which these institutions are built.

Enter the hero of our story: Cyber insurance. In an age where digital threats can emerge from any corner of the globe, insurance isn’t just a safety net—it’s a critical component of a comprehensive cybersecurity strategy. Yet, as the narrative unfolds, one finds that navigating this realm is no simple feat. Through real data, harrowing tales of breaches, and the beacon of best practices, this blog aims to guide financial firms through the murky waters of cyber threats and into the safe harbour of robust protection.

The Rise of Cyber Threats in the Financial Sector

The digital transformation of the financial sector has unlocked new frontiers of efficiency and convenience. However, this evolution has not gone unnoticed by cybercriminals, who view the vast repositories of financial data as a lucrative target. According to a report by Cybersecurity Ventures, the global cost of cybercrime is expected to reach $10.5 trillion annually by 2025, with financial services being one of the most targeted sectors.

The Spectrum of Threats

Financial firms face a myriad of cyber threats, each with its unique characteristics and potential impacts. Some of the most prevalent include:

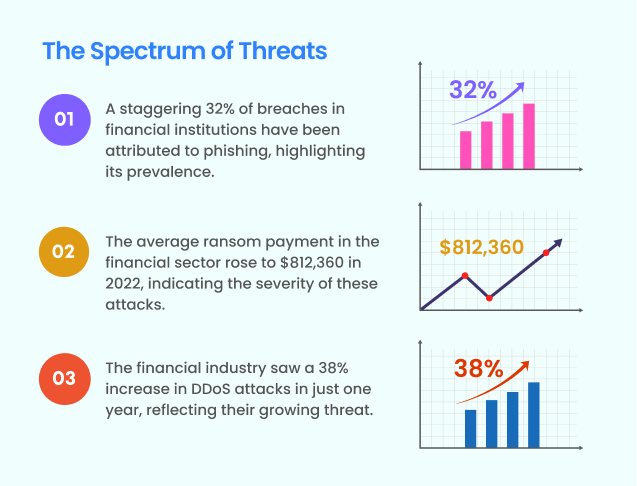

Phishing Attacks: These involve fraudulent communication, usually emails, designed to steal sensitive information.

A staggering 32% of breaches in financial institutions have been attributed to phishing, highlighting its prevalence.

Ransomware: This type of malware encrypts a victim’s files, demanding a ransom for their release.

The average ransom payment in the financial sector rose to $812,360 in 2022, indicating the severity of these attacks.

Distributed Denial of Service (DDoS) Attacks: These aim to overwhelm a firm’s digital resources, rendering services inaccessible to users.

The financial industry saw a 38% increase in DDoS attacks in just one year, reflecting their growing threat.

A Real-World Example: The Capital One Data Breach

In March 2019, Capital One, one of the largest banks in the United States, experienced a massive data breach affecting over 100 million individuals in the U.S. and approximately 6 million in Canada. The breach exposed sensitive information, including names, addresses, credit scores, and social security numbers. The incident was traced back to a configuration vulnerability in Capital One’s infrastructure hosted on a cloud service. A single hacker exploited this vulnerability, leading to one of the most significant data breaches in the banking sector.

The Capital One breach resulted in direct financial losses exceeding $150 million, including costs related to customer notifications, credit monitoring, technology costs, and legal support. Moreover, the incident significantly eroded customer trust and raised serious questions about the firm’s cybersecurity practices.

Impact of Cyber Threats on Financial Firms

The Capital One incident illustrates the extensive consequences of cyber incidents on financial firms. Beyond the immediate financial losses, the breach inflicted lasting damage on the bank’s reputation, leading to a loss of customer trust. The incident also spotlighted the regulatory implications of cybersecurity lapses, as Capital One faced investigations by various regulatory bodies and a potential class-action lawsuit from affected customers.

Understanding Cyber Insurance for Financial Firms

The Capital One case highlights the importance of cyber insurance as a critical component of a financial firm’s risk management strategy. Cyber insurance can offer a safety net, covering costs associated with data breaches, including legal fees, forensic investigations, and customer notifications. However, the scope of coverage and the specific terms can vary widely between policies, emphasising the need for firms to thoroughly assess their risks and coverage requirements.

The aftermath of the Capital One breach also reflected on the cyber insurance market, as insurers have become more cautious, leading to higher premiums and stricter underwriting standards. This trend underscores the growing recognition of cybersecurity risks and the critical role of cyber insurance in mitigating these threats.

Case Studies: Cyber Insurance in Action

NCR Corporation: A Tale of Ransomware Resilience

In a notable incident involving NCR Corporation, a technology provider to financial institutions, the company fell victim to a ransomware attack orchestrated by the BlackCat/ALPHV group. This attack spotlighted the risks associated with Point of Sale (POS) systems but notably, the attackers leveraged stolen credentials rather than financial data. This situation underscores the critical nature of supply chain security and the essential practices of robust access management, including the implementation of Multi-Factor Authentication (MFA) and regular vulnerability assessments to prevent similar incidents.

Financial Institutions: In the Crosshairs of Cybercriminals

The financial sector’s vulnerability to cyber threats has become increasingly pronounced, with a significant uptick in ransomware attacks observed from 2022 to 2023. The number of breaches experienced by financial and insurance organisations globally soared to 566, resulting in over 254 million compromised records. The financial repercussions of these breaches are staggering, with the average cost of a data breach in the finance sector reaching $5.9 million. This trend highlights the paramount importance of cybersecurity investments and the adoption of advanced protective measures to safeguard the financial sector against the evolving landscape of cyber threats.

Understanding Cyber Insurance for Financial Firms

The real-world impact of cyber incidents on financial firms and the role of cyber insurance in mitigating these risks cannot be overstated. Cyber insurance policies play a crucial role in covering the financial losses and supporting the recovery process, including ransom payments, forensic analysis, legal expenses, and customer compensations. However, as the threat landscape continues to evolve, so too must the scope and coverage of cyber insurance policies to address the growing sophistication of cyber attacks and the increasing regulatory pressures on financial institutions to protect customer data and maintain operational resilience.

Last Words

The cyberattacks on NCR Corporation and the broader financial industry underscore the complex and dynamic nature of cyber threats facing financial firms today. These incidents not only result in significant financial and reputational damage but also highlight the critical need for comprehensive cybersecurity strategies that include robust cyber insurance coverage. As financial firms navigate this challenging landscape, it is imperative that they remain vigilant, continuously update their cybersecurity and insurance measures, and foster a culture of security awareness within their organisations to safeguard against the ever-evolving cyber threats.

By drawing lessons from these real-world incidents and prioritising the adoption of cutting-edge security measures and comprehensive cyber insurance, financial firms can enhance their resilience against cyber threats and protect their assets, reputation, and the trust of their customers.

Mitigata: Smart Cyber Insurance

Mitigata, a smart cyber insurance provider, integrates seamlessly with your firm’s cybersecurity strategy, offering tailored insurance solutions that adapt to the specific risks and challenges your organisation faces.

With Mitigata’s advanced risk assessment tools and proactive risk management services, financial firms can not only secure comprehensive coverage but also gain valuable insights into their cybersecurity vulnerabilities, enabling them to make informed decisions and strengthen their defences against cyber threats.

This synergy between advanced cybersecurity practices and smart cyber insurance coverage is crucial for financial institutions aiming to navigate the digital landscape securely and confidently.

Understanding Exclusions in Cyber Insurance Policies

Introduction: The Critical Role of Cyber Insurance

As businesses march forward into the digital future, the spectre of cyber threats casts a long shadow over their progress. Cyber insurance has emerged as a bastion of financial resilience, shielding companies from the tempest of online risks. However, the assurance offered by these policies is not without its limitations, often delineated in the less traversed corridors of policy exclusions. Understanding these exclusions is paramount, as they delineate the boundary between security and vulnerability in the cyber insurance landscape.

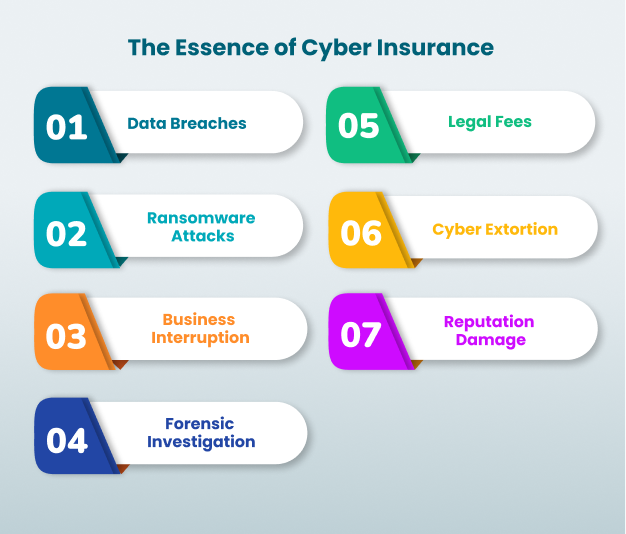

The Essence of Cyber Insurance

What Cyber Insurance Covers

Cyber insurance policies are designed to mitigate financial risks associated with digital activities. Coverage can vary but typically includes:

- Data Breaches: Costs related to the unauthorised access of data, including customer notification, credit monitoring services, and legal fees.

- Ransomware Attacks: Expenses for negotiating with attackers, paying ransoms (if deemed necessary), and recovering locked or stolen data.

- Business Interruption: Compensation for lost income and increased costs of operation due to a cyber event that disrupts business activities.

- Forensic Investigation: Fees for specialists to investigate the cause and extent of a cyber breach or attack.

- Legal Fees: Costs associated with privacy lawsuits and regulatory fines due to breaches of data protection laws.

- Cyber Extortion: Protection against demands made by a hacker threatening to damage or release data.

- Reputation Damage: Services to manage and mitigate damage to a company’s reputation following a cyber event.

It’s important to note that while these coverages are common, specific inclusions can differ significantly across policies and providers. Some policies may offer additional protections tailored to the unique risks faced by certain industries or operations.

The Importance of Knowing Your Policy

Thoroughly understanding your cyber insurance policy is crucial for several reasons:

- Identifies Coverage Gaps: Knowing the details helps identify any gaps between the risks your business faces and the protections your policy provides.

- Informs Risk Management Practices: Understanding what’s covered can guide your internal cybersecurity measures, highlighting areas where more robust precautions are necessary.

- Ensures Compliance: Many policies require adherence to specific security standards or protocols. Familiarity with these requirements ensures that your coverage remains valid.

- Facilitates Faster Response: Knowing the extent of your coverage allows for a quicker, more coordinated response in the event of a cyber incident, potentially minimising damage and costs.

- Aids in Financial Planning: Clear understanding of your policy helps in financial planning and budgeting for potential out-of-pocket expenses due to exclusions or coverage limits.

Given the diversity in policies, businesses should work closely with their insurers to clarify any ambiguous terms and ensure their coverage aligns with their specific risk profile and operational needs. Regular policy reviews are also advisable to adjust coverage as new cyber threats emerge and as the business grows or changes its operational model.

Common Exclusions in Cyber Insurance Policies

- Prior Acts and Retroactive Coverage – Many policies do not cover incidents that occurred before the policy’s inception date, emphasising the need for continuous coverage.

- Intentional Acts and Insider Threats – Acts of fraud or dishonesty by company insiders are often excluded, highlighting the importance of internal controls.

- Wear and Tear, Degradation – Gradual deterioration of systems is not typically covered, underscoring the need for regular maintenance and updates.

- Acts of War and Terrorism – Some policies exclude damages caused by warlike events or acts of terrorism, a notable consideration in today’s geopolitical climate.

The Importance of Risk Assessment

Regular risk assessments are a cornerstone of effective cybersecurity strategy, allowing businesses to pinpoint potential vulnerabilities in their systems and processes. By identifying these gaps, companies can tailor their cyber insurance policies to ensure they are adequately protected against specific threats. This proactive approach not only enhances security posture but also informs more strategic insurance purchasing decisions, aligning coverage with the unique risk landscape of each business. For instance, a company processing large volumes of sensitive customer data might prioritise coverage for data breaches and associated legal costs, while a cloud-based service provider might focus on protections against service interruptions and ransomware attacks.

Enhancing Your Coverage: Tips and Tricks

Regular reviews and negotiations of your policy can ensure that your coverage evolves alongside your business and the broader cyber threat landscape. Here are some Tips and Tricks to enhance your policy coverage:

- Conduct Annual Policy Reviews: Regularly review your policy with your insurer to ensure it matches your current business needs and risk profile.

- Stay Informed on Emerging Threats: Keep up with the latest cyber threats and trends to understand new risks that might affect your coverage needs.

- Negotiate for Custom Coverage: Don’t settle for generic policies. Negotiate terms that address the specific risks and needs of your business.

- Leverage Security Improvements for Lower Premiums: Implement recommended security measures to potentially qualify for lower insurance rates.

- Understand Policy Exclusions: Carefully review what is not covered by your policy and seek to minimise these gaps through negotiation or additional coverage.

- Consider Cybersecurity Certifications: Achieving recognized cybersecurity certifications can demonstrate to insurers that your business maintains high-security standards.

- Explore Multi-factor Authentication (MFA): Utilise MFA to strengthen your security posture and potentially negotiate better coverage terms.

- Regularly Update Security Protocols: Stay current with security updates and patches. Document these efforts to show insurers your commitment to cybersecurity.

- Diversify Your Cybersecurity Measures: Employ a range of security measures, including firewalls, anti-malware tools, and employee training programs.

- Consult with Cybersecurity Experts: Before renewing or purchasing new insurance, consult with cybersecurity professionals to identify any coverage gaps or enhancements needed.

The Future of Cyber Insurance

The realm of cyber insurance is rapidly evolving, driven by the continuous emergence of new digital threats and technological advancements. As cybercriminals become more sophisticated, leveraging artificial intelligence and machine learning to orchestrate attacks, insurers are responding by developing more nuanced policies that address these complex risk profiles. Future policies are likely to offer more customised coverage options, tailored to the specific needs and vulnerabilities of individual businesses.

Moreover, the increasing prevalence of state-sponsored cyber attacks and complex regulatory landscapes, such as the GDPR in Europe and various data protection laws across the globe, are influencing the direction of cyber insurance policies. Insurers are starting to offer more in the way of compliance assistance and coverage for regulatory fines and penalties, recognizing these as significant financial risks for businesses.

Conclusion: Smarter Protection with Mitigata

Mitigata’s smart cyber insurance offers a solution that not only meets the contemporary needs of businesses but also provides guidance on navigating and understanding policy exclusions. With Mitigata, companies can ensure they are adequately protected against both current and emerging digital threats, filling the gaps that traditional policies might leave uncovered.