Get End-to-end Cyber

Security ComplianceInsurance

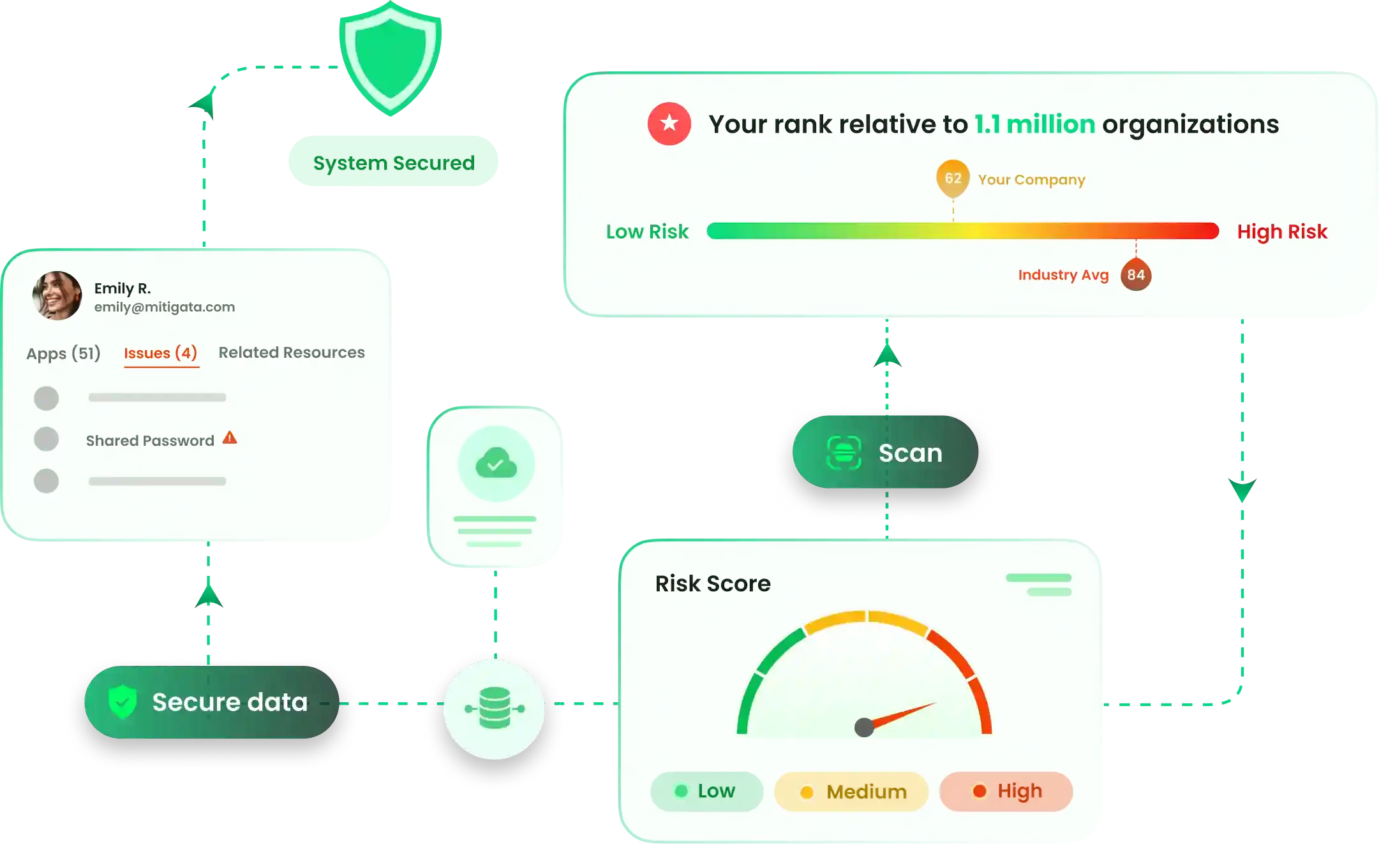

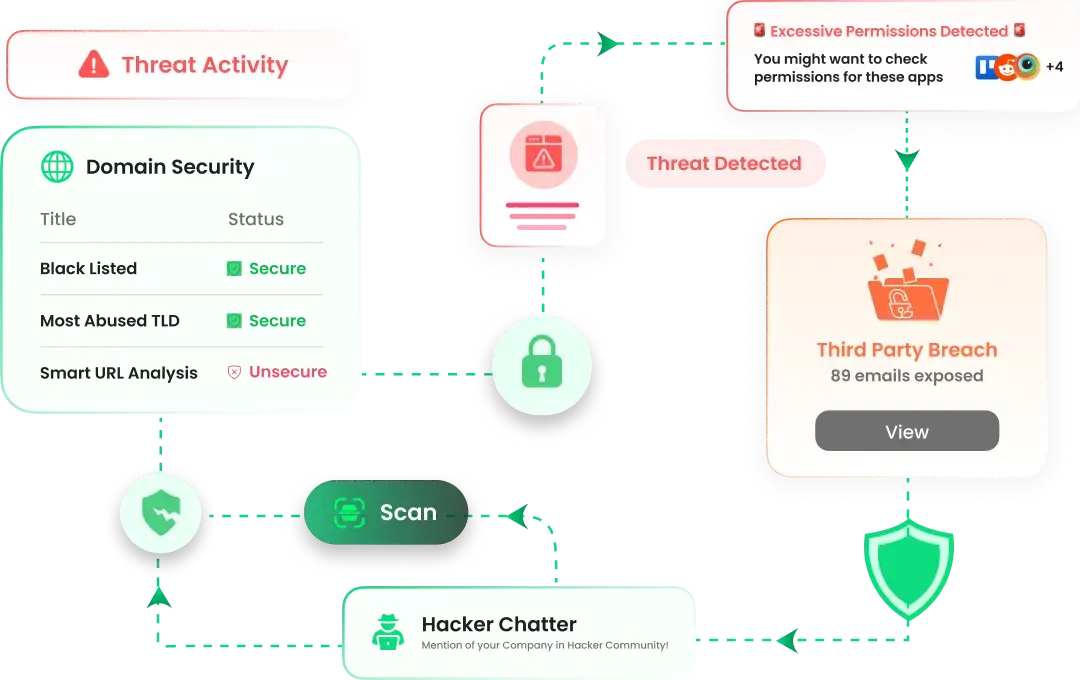

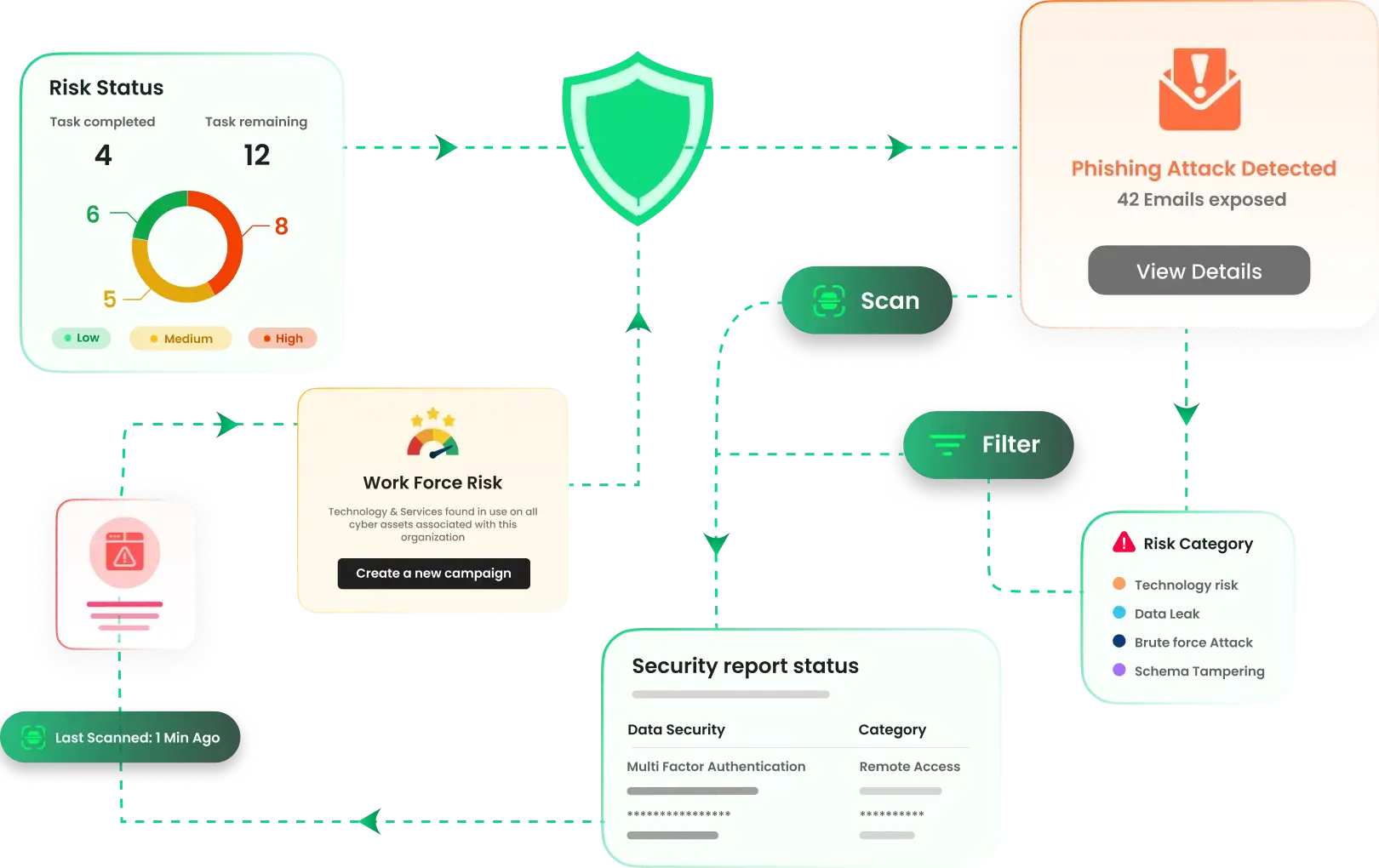

Mitigata delivers comprehensive cyber security products and managed services, compliance and regulatory consulting, and insurance solutions combining continuous risk assessment, monitoring, and advisory to protect businesses and individuals digitally.

SETUP, EASY-PEASY

The Best Cyber Liability Insurance does

more than just insure

Active Insurance

Mitigata's Active Insurance offers proactive digital protection. Beyond reacting to threats, we provide ongoing safety for your assets. Our approach ensures you're always covered, offering peace of mind through continuous security efforts.

Active Protection

Active Response

Serving 800+ Clients

Mitigata is proud to support a wide array of clients, including those in Fintech, Health Tech, B2B, Consumer Tech, Manufacturing, D2C , B2C and Logistics. Discover how we're making a difference in these industries and beyond!

Don't take our word for it,

Trust our Clients

Every journey starts with a challenge, but here at Mitigata, we turn challenges into triumphs. Read on to see how we've transformed struggles into success stories. For privacy and security, the identities of our clients are confidential. However, their stories of success and satisfaction with our services speak volumes.

Swift Service, Smiling Satisfaction

After a month of chasing cyber insurance quotes with no luck, Mitigata came through for us in just six days! They turned a frustrating process into a walk in the park, keeping us in the loop with speedy updates and stellar service. Now, we’re not just covered; we're covered with a smile. Big cheers to Mitigata for making our insurance experience a fairy tale ending!

CEO

Fintech

Exceeding Expectations with Excellence

Wow! Fast, friendly, and fiercely effective—that's how we'd describe our experience with Mitigata. After using their antivirus, ISO 27001 and other services, Mitigata exceeded our expectations with outstanding efficiency. We're not just satisfied—we're impressed and grateful for such reliable cybersecurity support.

CEO

IT/ITES

Compliance Made Comfortable

Mitigata has revolutionized our approach to compliance. Their easy connectivity and seamless service integration were impressive. Thanks to their fast processing, compliance is no longer a bottleneck for us. Exceptional service, highly recommended!

CEO

Enterprise Solutions

Safeguarding Confidence

Mitigata's Cyber Insurance and Professional Indemnity coverages have become pillars of trust for our team. In one instance, when a security incident nearly disrupted operations, the coverage and quick response we received kept us on track. Mitigata Console is our silent protector, alerting us to threats before they become problems. We can now move forward confidently, knowing that Mitigata has our back, come what may.

CTO

Fintech

Security Standards Reimagined

With Mitigata's help, we achieved ISO 27001 certification, and the impact on our operational security was immediate. Stakeholder confidence soared, and we saw a marked improvement in internal processes. Mitigata’s policy solutions also offer robust protection tailored to our dynamic needs in the tech sector. This journey with Mitigata has truly set us apart in security and operational resilience.

Compliance Officer

Information Technology

Ensuring Excellence in Liability

Mitigata’s PI and D&O insurance policies have been indispensable in helping us navigate complex liability scenarios. We faced a significant client situation recently, and thanks to their PI coverage, we were able to handle it without concern for unforeseen risks. Mitigata has proven to be a reliable partner in supporting both our reputation and our executives, ensuring we are always prepared for the unexpected.

Managing Partner

Cybersecurity

Swift Service, Smiling Satisfaction

After a month of chasing cyber insurance quotes with no luck, Mitigata came through for us in just six days! They turned a frustrating process into a walk in the park, keeping us in the loop with speedy updates and stellar service. Now, we’re not just covered; we're covered with a smile. Big cheers to Mitigata for making our insurance experience a fairy tale ending!

CEO

Fintech

Exceeding Expectations with Excellence

Wow! Fast, friendly, and fiercely effective—that's how we'd describe our experience with Mitigata. After using their antivirus, ISO 27001 and other services, Mitigata exceeded our expectations with outstanding efficiency. We're not just satisfied—we're impressed and grateful for such reliable cybersecurity support.

CEO

IT/ITES

Compliance Made Comfortable

Mitigata has revolutionized our approach to compliance. Their easy connectivity and seamless service integration were impressive. Thanks to their fast processing, compliance is no longer a bottleneck for us. Exceptional service, highly recommended!

CEO

Enterprise Solutions

Safeguarding Confidence

Mitigata's Cyber Insurance and Professional Indemnity coverages have become pillars of trust for our team. In one instance, when a security incident nearly disrupted operations, the coverage and quick response we received kept us on track. Mitigata Console is our silent protector, alerting us to threats before they become problems. We can now move forward confidently, knowing that Mitigata has our back, come what may.

CTO

Fintech

Security Standards Reimagined

With Mitigata's help, we achieved ISO 27001 certification, and the impact on our operational security was immediate. Stakeholder confidence soared, and we saw a marked improvement in internal processes. Mitigata’s policy solutions also offer robust protection tailored to our dynamic needs in the tech sector. This journey with Mitigata has truly set us apart in security and operational resilience.

Compliance Officer

Information Technology

Ensuring Excellence in Liability

Mitigata’s PI and D&O insurance policies have been indispensable in helping us navigate complex liability scenarios. We faced a significant client situation recently, and thanks to their PI coverage, we were able to handle it without concern for unforeseen risks. Mitigata has proven to be a reliable partner in supporting both our reputation and our executives, ensuring we are always prepared for the unexpected.

Managing Partner

Cybersecurity

Swift Service, Smiling Satisfaction

After a month of chasing cyber insurance quotes with no luck, Mitigata came through for us in just six days! They turned a frustrating process into a walk in the park, keeping us in the loop with speedy updates and stellar service. Now, we’re not just covered; we're covered with a smile. Big cheers to Mitigata for making our insurance experience a fairy tale ending!

CEO

Fintech

Exceeding Expectations with Excellence

Wow! Fast, friendly, and fiercely effective—that's how we'd describe our experience with Mitigata. After using their antivirus, ISO 27001 and other services, Mitigata exceeded our expectations with outstanding efficiency. We're not just satisfied—we're impressed and grateful for such reliable cybersecurity support.

CEO

IT/ITES

Compliance Made Comfortable

Mitigata has revolutionized our approach to compliance. Their easy connectivity and seamless service integration were impressive. Thanks to their fast processing, compliance is no longer a bottleneck for us. Exceptional service, highly recommended!

CEO

Enterprise Solutions

Safeguarding Confidence

Mitigata's Cyber Insurance and Professional Indemnity coverages have become pillars of trust for our team. In one instance, when a security incident nearly disrupted operations, the coverage and quick response we received kept us on track. Mitigata Console is our silent protector, alerting us to threats before they become problems. We can now move forward confidently, knowing that Mitigata has our back, come what may.

CTO

Fintech

Security Standards Reimagined

With Mitigata's help, we achieved ISO 27001 certification, and the impact on our operational security was immediate. Stakeholder confidence soared, and we saw a marked improvement in internal processes. Mitigata’s policy solutions also offer robust protection tailored to our dynamic needs in the tech sector. This journey with Mitigata has truly set us apart in security and operational resilience.

Compliance Officer

Information Technology

Ensuring Excellence in Liability

Mitigata’s PI and D&O insurance policies have been indispensable in helping us navigate complex liability scenarios. We faced a significant client situation recently, and thanks to their PI coverage, we were able to handle it without concern for unforeseen risks. Mitigata has proven to be a reliable partner in supporting both our reputation and our executives, ensuring we are always prepared for the unexpected.

Managing Partner

Cybersecurity

Swift Service, Smiling Satisfaction

After a month of chasing cyber insurance quotes with no luck, Mitigata came through for us in just six days! They turned a frustrating process into a walk in the park, keeping us in the loop with speedy updates and stellar service. Now, we’re not just covered; we're covered with a smile. Big cheers to Mitigata for making our insurance experience a fairy tale ending!

CEO

Fintech

Exceeding Expectations with Excellence

Wow! Fast, friendly, and fiercely effective—that's how we'd describe our experience with Mitigata. After using their antivirus, ISO 27001 and other services, Mitigata exceeded our expectations with outstanding efficiency. We're not just satisfied—we're impressed and grateful for such reliable cybersecurity support.

CEO

IT/ITES

Compliance Made Comfortable

Mitigata has revolutionized our approach to compliance. Their easy connectivity and seamless service integration were impressive. Thanks to their fast processing, compliance is no longer a bottleneck for us. Exceptional service, highly recommended!

CEO

Enterprise Solutions

Safeguarding Confidence

Mitigata's Cyber Insurance and Professional Indemnity coverages have become pillars of trust for our team. In one instance, when a security incident nearly disrupted operations, the coverage and quick response we received kept us on track. Mitigata Console is our silent protector, alerting us to threats before they become problems. We can now move forward confidently, knowing that Mitigata has our back, come what may.

CTO

Fintech

Security Standards Reimagined

With Mitigata's help, we achieved ISO 27001 certification, and the impact on our operational security was immediate. Stakeholder confidence soared, and we saw a marked improvement in internal processes. Mitigata’s policy solutions also offer robust protection tailored to our dynamic needs in the tech sector. This journey with Mitigata has truly set us apart in security and operational resilience.

Compliance Officer

Information Technology

Ensuring Excellence in Liability

Mitigata’s PI and D&O insurance policies have been indispensable in helping us navigate complex liability scenarios. We faced a significant client situation recently, and thanks to their PI coverage, we were able to handle it without concern for unforeseen risks. Mitigata has proven to be a reliable partner in supporting both our reputation and our executives, ensuring we are always prepared for the unexpected.

Managing Partner

Cybersecurity

Swift Service, Smiling Satisfaction

After a month of chasing cyber insurance quotes with no luck, Mitigata came through for us in just six days! They turned a frustrating process into a walk in the park, keeping us in the loop with speedy updates and stellar service. Now, we’re not just covered; we're covered with a smile. Big cheers to Mitigata for making our insurance experience a fairy tale ending!

CEO

Fintech

Exceeding Expectations with Excellence

Wow! Fast, friendly, and fiercely effective—that's how we'd describe our experience with Mitigata. After using their antivirus, ISO 27001 and other services, Mitigata exceeded our expectations with outstanding efficiency. We're not just satisfied—we're impressed and grateful for such reliable cybersecurity support.

CEO

IT/ITES

Compliance Made Comfortable

Mitigata has revolutionized our approach to compliance. Their easy connectivity and seamless service integration were impressive. Thanks to their fast processing, compliance is no longer a bottleneck for us. Exceptional service, highly recommended!

CEO

Enterprise Solutions

Safeguarding Confidence

Mitigata's Cyber Insurance and Professional Indemnity coverages have become pillars of trust for our team. In one instance, when a security incident nearly disrupted operations, the coverage and quick response we received kept us on track. Mitigata Console is our silent protector, alerting us to threats before they become problems. We can now move forward confidently, knowing that Mitigata has our back, come what may.

CTO

Fintech

Security Standards Reimagined

With Mitigata's help, we achieved ISO 27001 certification, and the impact on our operational security was immediate. Stakeholder confidence soared, and we saw a marked improvement in internal processes. Mitigata’s policy solutions also offer robust protection tailored to our dynamic needs in the tech sector. This journey with Mitigata has truly set us apart in security and operational resilience.

Compliance Officer

Information Technology

Ensuring Excellence in Liability

Mitigata’s PI and D&O insurance policies have been indispensable in helping us navigate complex liability scenarios. We faced a significant client situation recently, and thanks to their PI coverage, we were able to handle it without concern for unforeseen risks. Mitigata has proven to be a reliable partner in supporting both our reputation and our executives, ensuring we are always prepared for the unexpected.

Managing Partner

Cybersecurity

Swift Service, Smiling Satisfaction

After a month of chasing cyber insurance quotes with no luck, Mitigata came through for us in just six days! They turned a frustrating process into a walk in the park, keeping us in the loop with speedy updates and stellar service. Now, we’re not just covered; we're covered with a smile. Big cheers to Mitigata for making our insurance experience a fairy tale ending!

CEO

Fintech

Exceeding Expectations with Excellence

Wow! Fast, friendly, and fiercely effective—that's how we'd describe our experience with Mitigata. After using their antivirus, ISO 27001 and other services, Mitigata exceeded our expectations with outstanding efficiency. We're not just satisfied—we're impressed and grateful for such reliable cybersecurity support.

CEO

IT/ITES

Compliance Made Comfortable

Mitigata has revolutionized our approach to compliance. Their easy connectivity and seamless service integration were impressive. Thanks to their fast processing, compliance is no longer a bottleneck for us. Exceptional service, highly recommended!

CEO

Enterprise Solutions

Safeguarding Confidence

Mitigata's Cyber Insurance and Professional Indemnity coverages have become pillars of trust for our team. In one instance, when a security incident nearly disrupted operations, the coverage and quick response we received kept us on track. Mitigata Console is our silent protector, alerting us to threats before they become problems. We can now move forward confidently, knowing that Mitigata has our back, come what may.

CTO

Fintech

Security Standards Reimagined

With Mitigata's help, we achieved ISO 27001 certification, and the impact on our operational security was immediate. Stakeholder confidence soared, and we saw a marked improvement in internal processes. Mitigata’s policy solutions also offer robust protection tailored to our dynamic needs in the tech sector. This journey with Mitigata has truly set us apart in security and operational resilience.

Compliance Officer

Information Technology

Ensuring Excellence in Liability

Mitigata’s PI and D&O insurance policies have been indispensable in helping us navigate complex liability scenarios. We faced a significant client situation recently, and thanks to their PI coverage, we were able to handle it without concern for unforeseen risks. Mitigata has proven to be a reliable partner in supporting both our reputation and our executives, ensuring we are always prepared for the unexpected.

Managing Partner

Cybersecurity

Swift Service, Smiling Satisfaction

After a month of chasing cyber insurance quotes with no luck, Mitigata came through for us in just six days! They turned a frustrating process into a walk in the park, keeping us in the loop with speedy updates and stellar service. Now, we’re not just covered; we're covered with a smile. Big cheers to Mitigata for making our insurance experience a fairy tale ending!

CEO

Fintech

Exceeding Expectations with Excellence

Wow! Fast, friendly, and fiercely effective—that's how we'd describe our experience with Mitigata. After using their antivirus, ISO 27001 and other services, Mitigata exceeded our expectations with outstanding efficiency. We're not just satisfied—we're impressed and grateful for such reliable cybersecurity support.

CEO

IT/ITES

Compliance Made Comfortable

Mitigata has revolutionized our approach to compliance. Their easy connectivity and seamless service integration were impressive. Thanks to their fast processing, compliance is no longer a bottleneck for us. Exceptional service, highly recommended!

CEO

Enterprise Solutions

Safeguarding Confidence

Mitigata's Cyber Insurance and Professional Indemnity coverages have become pillars of trust for our team. In one instance, when a security incident nearly disrupted operations, the coverage and quick response we received kept us on track. Mitigata Console is our silent protector, alerting us to threats before they become problems. We can now move forward confidently, knowing that Mitigata has our back, come what may.

CTO

Fintech

Security Standards Reimagined

With Mitigata's help, we achieved ISO 27001 certification, and the impact on our operational security was immediate. Stakeholder confidence soared, and we saw a marked improvement in internal processes. Mitigata’s policy solutions also offer robust protection tailored to our dynamic needs in the tech sector. This journey with Mitigata has truly set us apart in security and operational resilience.

Compliance Officer

Information Technology

Ensuring Excellence in Liability

Mitigata’s PI and D&O insurance policies have been indispensable in helping us navigate complex liability scenarios. We faced a significant client situation recently, and thanks to their PI coverage, we were able to handle it without concern for unforeseen risks. Mitigata has proven to be a reliable partner in supporting both our reputation and our executives, ensuring we are always prepared for the unexpected.

Managing Partner

Cybersecurity

Swift Service, Smiling Satisfaction

After a month of chasing cyber insurance quotes with no luck, Mitigata came through for us in just six days! They turned a frustrating process into a walk in the park, keeping us in the loop with speedy updates and stellar service. Now, we’re not just covered; we're covered with a smile. Big cheers to Mitigata for making our insurance experience a fairy tale ending!

CEO

Fintech

Exceeding Expectations with Excellence

Wow! Fast, friendly, and fiercely effective—that's how we'd describe our experience with Mitigata. After using their antivirus, ISO 27001 and other services, Mitigata exceeded our expectations with outstanding efficiency. We're not just satisfied—we're impressed and grateful for such reliable cybersecurity support.

CEO

IT/ITES

Compliance Made Comfortable

Mitigata has revolutionized our approach to compliance. Their easy connectivity and seamless service integration were impressive. Thanks to their fast processing, compliance is no longer a bottleneck for us. Exceptional service, highly recommended!

CEO

Enterprise Solutions

Safeguarding Confidence

Mitigata's Cyber Insurance and Professional Indemnity coverages have become pillars of trust for our team. In one instance, when a security incident nearly disrupted operations, the coverage and quick response we received kept us on track. Mitigata Console is our silent protector, alerting us to threats before they become problems. We can now move forward confidently, knowing that Mitigata has our back, come what may.

CTO

Fintech

Security Standards Reimagined

With Mitigata's help, we achieved ISO 27001 certification, and the impact on our operational security was immediate. Stakeholder confidence soared, and we saw a marked improvement in internal processes. Mitigata’s policy solutions also offer robust protection tailored to our dynamic needs in the tech sector. This journey with Mitigata has truly set us apart in security and operational resilience.

Compliance Officer

Information Technology

Ensuring Excellence in Liability

Mitigata’s PI and D&O insurance policies have been indispensable in helping us navigate complex liability scenarios. We faced a significant client situation recently, and thanks to their PI coverage, we were able to handle it without concern for unforeseen risks. Mitigata has proven to be a reliable partner in supporting both our reputation and our executives, ensuring we are always prepared for the unexpected.

Managing Partner

Cybersecurity

Swift Service, Smiling Satisfaction

After a month of chasing cyber insurance quotes with no luck, Mitigata came through for us in just six days! They turned a frustrating process into a walk in the park, keeping us in the loop with speedy updates and stellar service. Now, we’re not just covered; we're covered with a smile. Big cheers to Mitigata for making our insurance experience a fairy tale ending!

CEO

Fintech

Exceeding Expectations with Excellence

Wow! Fast, friendly, and fiercely effective—that's how we'd describe our experience with Mitigata. After using their antivirus, ISO 27001 and other services, Mitigata exceeded our expectations with outstanding efficiency. We're not just satisfied—we're impressed and grateful for such reliable cybersecurity support.

CEO

IT/ITES

Compliance Made Comfortable

Mitigata has revolutionized our approach to compliance. Their easy connectivity and seamless service integration were impressive. Thanks to their fast processing, compliance is no longer a bottleneck for us. Exceptional service, highly recommended!

CEO

Enterprise Solutions

Safeguarding Confidence

Mitigata's Cyber Insurance and Professional Indemnity coverages have become pillars of trust for our team. In one instance, when a security incident nearly disrupted operations, the coverage and quick response we received kept us on track. Mitigata Console is our silent protector, alerting us to threats before they become problems. We can now move forward confidently, knowing that Mitigata has our back, come what may.

CTO

Fintech

Security Standards Reimagined

With Mitigata's help, we achieved ISO 27001 certification, and the impact on our operational security was immediate. Stakeholder confidence soared, and we saw a marked improvement in internal processes. Mitigata’s policy solutions also offer robust protection tailored to our dynamic needs in the tech sector. This journey with Mitigata has truly set us apart in security and operational resilience.

Compliance Officer

Information Technology

Ensuring Excellence in Liability

Mitigata’s PI and D&O insurance policies have been indispensable in helping us navigate complex liability scenarios. We faced a significant client situation recently, and thanks to their PI coverage, we were able to handle it without concern for unforeseen risks. Mitigata has proven to be a reliable partner in supporting both our reputation and our executives, ensuring we are always prepared for the unexpected.

Managing Partner

Cybersecurity

Swift Service, Smiling Satisfaction

After a month of chasing cyber insurance quotes with no luck, Mitigata came through for us in just six days! They turned a frustrating process into a walk in the park, keeping us in the loop with speedy updates and stellar service. Now, we’re not just covered; we're covered with a smile. Big cheers to Mitigata for making our insurance experience a fairy tale ending!

CEO

Fintech

Exceeding Expectations with Excellence

Wow! Fast, friendly, and fiercely effective—that's how we'd describe our experience with Mitigata. After using their antivirus, ISO 27001 and other services, Mitigata exceeded our expectations with outstanding efficiency. We're not just satisfied—we're impressed and grateful for such reliable cybersecurity support.

CEO

IT/ITES

Compliance Made Comfortable

Mitigata has revolutionized our approach to compliance. Their easy connectivity and seamless service integration were impressive. Thanks to their fast processing, compliance is no longer a bottleneck for us. Exceptional service, highly recommended!

CEO

Enterprise Solutions

Safeguarding Confidence

Mitigata's Cyber Insurance and Professional Indemnity coverages have become pillars of trust for our team. In one instance, when a security incident nearly disrupted operations, the coverage and quick response we received kept us on track. Mitigata Console is our silent protector, alerting us to threats before they become problems. We can now move forward confidently, knowing that Mitigata has our back, come what may.

CTO

Fintech

Security Standards Reimagined

With Mitigata's help, we achieved ISO 27001 certification, and the impact on our operational security was immediate. Stakeholder confidence soared, and we saw a marked improvement in internal processes. Mitigata’s policy solutions also offer robust protection tailored to our dynamic needs in the tech sector. This journey with Mitigata has truly set us apart in security and operational resilience.

Compliance Officer

Information Technology

Ensuring Excellence in Liability

Mitigata’s PI and D&O insurance policies have been indispensable in helping us navigate complex liability scenarios. We faced a significant client situation recently, and thanks to their PI coverage, we were able to handle it without concern for unforeseen risks. Mitigata has proven to be a reliable partner in supporting both our reputation and our executives, ensuring we are always prepared for the unexpected.

Managing Partner

Cybersecurity

Swift Service, Smiling Satisfaction

After a month of chasing cyber insurance quotes with no luck, Mitigata came through for us in just six days! They turned a frustrating process into a walk in the park, keeping us in the loop with speedy updates and stellar service. Now, we’re not just covered; we're covered with a smile. Big cheers to Mitigata for making our insurance experience a fairy tale ending!

CEO

Fintech

Exceeding Expectations with Excellence

Wow! Fast, friendly, and fiercely effective—that's how we'd describe our experience with Mitigata. After using their antivirus, ISO 27001 and other services, Mitigata exceeded our expectations with outstanding efficiency. We're not just satisfied—we're impressed and grateful for such reliable cybersecurity support.

CEO

IT/ITES

Compliance Made Comfortable

Mitigata has revolutionized our approach to compliance. Their easy connectivity and seamless service integration were impressive. Thanks to their fast processing, compliance is no longer a bottleneck for us. Exceptional service, highly recommended!

CEO

Enterprise Solutions

Safeguarding Confidence

Mitigata's Cyber Insurance and Professional Indemnity coverages have become pillars of trust for our team. In one instance, when a security incident nearly disrupted operations, the coverage and quick response we received kept us on track. Mitigata Console is our silent protector, alerting us to threats before they become problems. We can now move forward confidently, knowing that Mitigata has our back, come what may.

CTO

Fintech

Security Standards Reimagined

With Mitigata's help, we achieved ISO 27001 certification, and the impact on our operational security was immediate. Stakeholder confidence soared, and we saw a marked improvement in internal processes. Mitigata’s policy solutions also offer robust protection tailored to our dynamic needs in the tech sector. This journey with Mitigata has truly set us apart in security and operational resilience.

Compliance Officer

Information Technology

Ensuring Excellence in Liability

Mitigata’s PI and D&O insurance policies have been indispensable in helping us navigate complex liability scenarios. We faced a significant client situation recently, and thanks to their PI coverage, we were able to handle it without concern for unforeseen risks. Mitigata has proven to be a reliable partner in supporting both our reputation and our executives, ensuring we are always prepared for the unexpected.

Managing Partner

Cybersecurity

Swift Service, Smiling Satisfaction

After a month of chasing cyber insurance quotes with no luck, Mitigata came through for us in just six days! They turned a frustrating process into a walk in the park, keeping us in the loop with speedy updates and stellar service. Now, we’re not just covered; we're covered with a smile. Big cheers to Mitigata for making our insurance experience a fairy tale ending!

CEO

Fintech

Exceeding Expectations with Excellence

Wow! Fast, friendly, and fiercely effective—that's how we'd describe our experience with Mitigata. After using their antivirus, ISO 27001 and other services, Mitigata exceeded our expectations with outstanding efficiency. We're not just satisfied—we're impressed and grateful for such reliable cybersecurity support.

CEO

IT/ITES

Compliance Made Comfortable

Mitigata has revolutionized our approach to compliance. Their easy connectivity and seamless service integration were impressive. Thanks to their fast processing, compliance is no longer a bottleneck for us. Exceptional service, highly recommended!

CEO

Enterprise Solutions

Safeguarding Confidence

Mitigata's Cyber Insurance and Professional Indemnity coverages have become pillars of trust for our team. In one instance, when a security incident nearly disrupted operations, the coverage and quick response we received kept us on track. Mitigata Console is our silent protector, alerting us to threats before they become problems. We can now move forward confidently, knowing that Mitigata has our back, come what may.

CTO

Fintech

Security Standards Reimagined

With Mitigata's help, we achieved ISO 27001 certification, and the impact on our operational security was immediate. Stakeholder confidence soared, and we saw a marked improvement in internal processes. Mitigata’s policy solutions also offer robust protection tailored to our dynamic needs in the tech sector. This journey with Mitigata has truly set us apart in security and operational resilience.

Compliance Officer

Information Technology

Ensuring Excellence in Liability

Mitigata’s PI and D&O insurance policies have been indispensable in helping us navigate complex liability scenarios. We faced a significant client situation recently, and thanks to their PI coverage, we were able to handle it without concern for unforeseen risks. Mitigata has proven to be a reliable partner in supporting both our reputation and our executives, ensuring we are always prepared for the unexpected.

Managing Partner

Cybersecurity

Swift Service, Smiling Satisfaction

After a month of chasing cyber insurance quotes with no luck, Mitigata came through for us in just six days! They turned a frustrating process into a walk in the park, keeping us in the loop with speedy updates and stellar service. Now, we’re not just covered; we're covered with a smile. Big cheers to Mitigata for making our insurance experience a fairy tale ending!

CEO

Fintech

Exceeding Expectations with Excellence

Wow! Fast, friendly, and fiercely effective—that's how we'd describe our experience with Mitigata. After using their antivirus, ISO 27001 and other services, Mitigata exceeded our expectations with outstanding efficiency. We're not just satisfied—we're impressed and grateful for such reliable cybersecurity support.

CEO

IT/ITES

Compliance Made Comfortable

Mitigata has revolutionized our approach to compliance. Their easy connectivity and seamless service integration were impressive. Thanks to their fast processing, compliance is no longer a bottleneck for us. Exceptional service, highly recommended!

CEO

Enterprise Solutions

Safeguarding Confidence

Mitigata's Cyber Insurance and Professional Indemnity coverages have become pillars of trust for our team. In one instance, when a security incident nearly disrupted operations, the coverage and quick response we received kept us on track. Mitigata Console is our silent protector, alerting us to threats before they become problems. We can now move forward confidently, knowing that Mitigata has our back, come what may.

CTO

Fintech

Security Standards Reimagined

With Mitigata's help, we achieved ISO 27001 certification, and the impact on our operational security was immediate. Stakeholder confidence soared, and we saw a marked improvement in internal processes. Mitigata’s policy solutions also offer robust protection tailored to our dynamic needs in the tech sector. This journey with Mitigata has truly set us apart in security and operational resilience.

Compliance Officer

Information Technology

Ensuring Excellence in Liability

Mitigata’s PI and D&O insurance policies have been indispensable in helping us navigate complex liability scenarios. We faced a significant client situation recently, and thanks to their PI coverage, we were able to handle it without concern for unforeseen risks. Mitigata has proven to be a reliable partner in supporting both our reputation and our executives, ensuring we are always prepared for the unexpected.

Managing Partner

Cybersecurity

Swift Service, Smiling Satisfaction

After a month of chasing cyber insurance quotes with no luck, Mitigata came through for us in just six days! They turned a frustrating process into a walk in the park, keeping us in the loop with speedy updates and stellar service. Now, we’re not just covered; we're covered with a smile. Big cheers to Mitigata for making our insurance experience a fairy tale ending!

CEO

Fintech

Exceeding Expectations with Excellence

Wow! Fast, friendly, and fiercely effective—that's how we'd describe our experience with Mitigata. After using their antivirus, ISO 27001 and other services, Mitigata exceeded our expectations with outstanding efficiency. We're not just satisfied—we're impressed and grateful for such reliable cybersecurity support.

CEO

IT/ITES

Compliance Made Comfortable

Mitigata has revolutionized our approach to compliance. Their easy connectivity and seamless service integration were impressive. Thanks to their fast processing, compliance is no longer a bottleneck for us. Exceptional service, highly recommended!

CEO

Enterprise Solutions

Safeguarding Confidence

Mitigata's Cyber Insurance and Professional Indemnity coverages have become pillars of trust for our team. In one instance, when a security incident nearly disrupted operations, the coverage and quick response we received kept us on track. Mitigata Console is our silent protector, alerting us to threats before they become problems. We can now move forward confidently, knowing that Mitigata has our back, come what may.

CTO

Fintech

Security Standards Reimagined

With Mitigata's help, we achieved ISO 27001 certification, and the impact on our operational security was immediate. Stakeholder confidence soared, and we saw a marked improvement in internal processes. Mitigata’s policy solutions also offer robust protection tailored to our dynamic needs in the tech sector. This journey with Mitigata has truly set us apart in security and operational resilience.

Compliance Officer

Information Technology

Ensuring Excellence in Liability

Mitigata’s PI and D&O insurance policies have been indispensable in helping us navigate complex liability scenarios. We faced a significant client situation recently, and thanks to their PI coverage, we were able to handle it without concern for unforeseen risks. Mitigata has proven to be a reliable partner in supporting both our reputation and our executives, ensuring we are always prepared for the unexpected.

Managing Partner

Cybersecurity

Swift Service, Smiling Satisfaction

After a month of chasing cyber insurance quotes with no luck, Mitigata came through for us in just six days! They turned a frustrating process into a walk in the park, keeping us in the loop with speedy updates and stellar service. Now, we’re not just covered; we're covered with a smile. Big cheers to Mitigata for making our insurance experience a fairy tale ending!

CEO

Fintech

Exceeding Expectations with Excellence

Wow! Fast, friendly, and fiercely effective—that's how we'd describe our experience with Mitigata. After using their antivirus, ISO 27001 and other services, Mitigata exceeded our expectations with outstanding efficiency. We're not just satisfied—we're impressed and grateful for such reliable cybersecurity support.

CEO

IT/ITES

Compliance Made Comfortable

Mitigata has revolutionized our approach to compliance. Their easy connectivity and seamless service integration were impressive. Thanks to their fast processing, compliance is no longer a bottleneck for us. Exceptional service, highly recommended!

CEO

Enterprise Solutions

Safeguarding Confidence

Mitigata's Cyber Insurance and Professional Indemnity coverages have become pillars of trust for our team. In one instance, when a security incident nearly disrupted operations, the coverage and quick response we received kept us on track. Mitigata Console is our silent protector, alerting us to threats before they become problems. We can now move forward confidently, knowing that Mitigata has our back, come what may.

CTO

Fintech

Security Standards Reimagined

With Mitigata's help, we achieved ISO 27001 certification, and the impact on our operational security was immediate. Stakeholder confidence soared, and we saw a marked improvement in internal processes. Mitigata’s policy solutions also offer robust protection tailored to our dynamic needs in the tech sector. This journey with Mitigata has truly set us apart in security and operational resilience.

Compliance Officer

Information Technology

Ensuring Excellence in Liability

Mitigata’s PI and D&O insurance policies have been indispensable in helping us navigate complex liability scenarios. We faced a significant client situation recently, and thanks to their PI coverage, we were able to handle it without concern for unforeseen risks. Mitigata has proven to be a reliable partner in supporting both our reputation and our executives, ensuring we are always prepared for the unexpected.

Managing Partner

Cybersecurity

Swift Service, Smiling Satisfaction

After a month of chasing cyber insurance quotes with no luck, Mitigata came through for us in just six days! They turned a frustrating process into a walk in the park, keeping us in the loop with speedy updates and stellar service. Now, we’re not just covered; we're covered with a smile. Big cheers to Mitigata for making our insurance experience a fairy tale ending!

CEO

Fintech

Exceeding Expectations with Excellence

Wow! Fast, friendly, and fiercely effective—that's how we'd describe our experience with Mitigata. After using their antivirus, ISO 27001 and other services, Mitigata exceeded our expectations with outstanding efficiency. We're not just satisfied—we're impressed and grateful for such reliable cybersecurity support.

CEO

IT/ITES

Compliance Made Comfortable

Mitigata has revolutionized our approach to compliance. Their easy connectivity and seamless service integration were impressive. Thanks to their fast processing, compliance is no longer a bottleneck for us. Exceptional service, highly recommended!

CEO

Enterprise Solutions

Safeguarding Confidence

Mitigata's Cyber Insurance and Professional Indemnity coverages have become pillars of trust for our team. In one instance, when a security incident nearly disrupted operations, the coverage and quick response we received kept us on track. Mitigata Console is our silent protector, alerting us to threats before they become problems. We can now move forward confidently, knowing that Mitigata has our back, come what may.

CTO

Fintech

Security Standards Reimagined

With Mitigata's help, we achieved ISO 27001 certification, and the impact on our operational security was immediate. Stakeholder confidence soared, and we saw a marked improvement in internal processes. Mitigata’s policy solutions also offer robust protection tailored to our dynamic needs in the tech sector. This journey with Mitigata has truly set us apart in security and operational resilience.

Compliance Officer

Information Technology

Ensuring Excellence in Liability

Mitigata’s PI and D&O insurance policies have been indispensable in helping us navigate complex liability scenarios. We faced a significant client situation recently, and thanks to their PI coverage, we were able to handle it without concern for unforeseen risks. Mitigata has proven to be a reliable partner in supporting both our reputation and our executives, ensuring we are always prepared for the unexpected.

Managing Partner

Cybersecurity

Swift Service, Smiling Satisfaction

After a month of chasing cyber insurance quotes with no luck, Mitigata came through for us in just six days! They turned a frustrating process into a walk in the park, keeping us in the loop with speedy updates and stellar service. Now, we’re not just covered; we're covered with a smile. Big cheers to Mitigata for making our insurance experience a fairy tale ending!

CEO

Fintech

Exceeding Expectations with Excellence

Wow! Fast, friendly, and fiercely effective—that's how we'd describe our experience with Mitigata. After using their antivirus, ISO 27001 and other services, Mitigata exceeded our expectations with outstanding efficiency. We're not just satisfied—we're impressed and grateful for such reliable cybersecurity support.

CEO

IT/ITES

Compliance Made Comfortable

Mitigata has revolutionized our approach to compliance. Their easy connectivity and seamless service integration were impressive. Thanks to their fast processing, compliance is no longer a bottleneck for us. Exceptional service, highly recommended!

CEO

Enterprise Solutions

Safeguarding Confidence

Mitigata's Cyber Insurance and Professional Indemnity coverages have become pillars of trust for our team. In one instance, when a security incident nearly disrupted operations, the coverage and quick response we received kept us on track. Mitigata Console is our silent protector, alerting us to threats before they become problems. We can now move forward confidently, knowing that Mitigata has our back, come what may.

CTO

Fintech

Security Standards Reimagined

With Mitigata's help, we achieved ISO 27001 certification, and the impact on our operational security was immediate. Stakeholder confidence soared, and we saw a marked improvement in internal processes. Mitigata’s policy solutions also offer robust protection tailored to our dynamic needs in the tech sector. This journey with Mitigata has truly set us apart in security and operational resilience.

Compliance Officer

Information Technology

Ensuring Excellence in Liability

Mitigata’s PI and D&O insurance policies have been indispensable in helping us navigate complex liability scenarios. We faced a significant client situation recently, and thanks to their PI coverage, we were able to handle it without concern for unforeseen risks. Mitigata has proven to be a reliable partner in supporting both our reputation and our executives, ensuring we are always prepared for the unexpected.

Managing Partner

Cybersecurity

Swift Service, Smiling Satisfaction

After a month of chasing cyber insurance quotes with no luck, Mitigata came through for us in just six days! They turned a frustrating process into a walk in the park, keeping us in the loop with speedy updates and stellar service. Now, we’re not just covered; we're covered with a smile. Big cheers to Mitigata for making our insurance experience a fairy tale ending!

CEO

Fintech

Exceeding Expectations with Excellence

Wow! Fast, friendly, and fiercely effective—that's how we'd describe our experience with Mitigata. After using their antivirus, ISO 27001 and other services, Mitigata exceeded our expectations with outstanding efficiency. We're not just satisfied—we're impressed and grateful for such reliable cybersecurity support.

CEO

IT/ITES

Compliance Made Comfortable

Mitigata has revolutionized our approach to compliance. Their easy connectivity and seamless service integration were impressive. Thanks to their fast processing, compliance is no longer a bottleneck for us. Exceptional service, highly recommended!

CEO

Enterprise Solutions

Safeguarding Confidence

Mitigata's Cyber Insurance and Professional Indemnity coverages have become pillars of trust for our team. In one instance, when a security incident nearly disrupted operations, the coverage and quick response we received kept us on track. Mitigata Console is our silent protector, alerting us to threats before they become problems. We can now move forward confidently, knowing that Mitigata has our back, come what may.

CTO

Fintech

Security Standards Reimagined

With Mitigata's help, we achieved ISO 27001 certification, and the impact on our operational security was immediate. Stakeholder confidence soared, and we saw a marked improvement in internal processes. Mitigata’s policy solutions also offer robust protection tailored to our dynamic needs in the tech sector. This journey with Mitigata has truly set us apart in security and operational resilience.

Compliance Officer

Information Technology

Ensuring Excellence in Liability

Mitigata’s PI and D&O insurance policies have been indispensable in helping us navigate complex liability scenarios. We faced a significant client situation recently, and thanks to their PI coverage, we were able to handle it without concern for unforeseen risks. Mitigata has proven to be a reliable partner in supporting both our reputation and our executives, ensuring we are always prepared for the unexpected.

Managing Partner

Cybersecurity

Swift Service, Smiling Satisfaction

After a month of chasing cyber insurance quotes with no luck, Mitigata came through for us in just six days! They turned a frustrating process into a walk in the park, keeping us in the loop with speedy updates and stellar service. Now, we’re not just covered; we're covered with a smile. Big cheers to Mitigata for making our insurance experience a fairy tale ending!

CEO

Fintech

Exceeding Expectations with Excellence

Wow! Fast, friendly, and fiercely effective—that's how we'd describe our experience with Mitigata. After using their antivirus, ISO 27001 and other services, Mitigata exceeded our expectations with outstanding efficiency. We're not just satisfied—we're impressed and grateful for such reliable cybersecurity support.

CEO

IT/ITES

Compliance Made Comfortable

Mitigata has revolutionized our approach to compliance. Their easy connectivity and seamless service integration were impressive. Thanks to their fast processing, compliance is no longer a bottleneck for us. Exceptional service, highly recommended!

CEO

Enterprise Solutions

Safeguarding Confidence

Mitigata's Cyber Insurance and Professional Indemnity coverages have become pillars of trust for our team. In one instance, when a security incident nearly disrupted operations, the coverage and quick response we received kept us on track. Mitigata Console is our silent protector, alerting us to threats before they become problems. We can now move forward confidently, knowing that Mitigata has our back, come what may.

CTO

Fintech

Security Standards Reimagined

With Mitigata's help, we achieved ISO 27001 certification, and the impact on our operational security was immediate. Stakeholder confidence soared, and we saw a marked improvement in internal processes. Mitigata’s policy solutions also offer robust protection tailored to our dynamic needs in the tech sector. This journey with Mitigata has truly set us apart in security and operational resilience.

Compliance Officer

Information Technology

Ensuring Excellence in Liability

Mitigata’s PI and D&O insurance policies have been indispensable in helping us navigate complex liability scenarios. We faced a significant client situation recently, and thanks to their PI coverage, we were able to handle it without concern for unforeseen risks. Mitigata has proven to be a reliable partner in supporting both our reputation and our executives, ensuring we are always prepared for the unexpected.

Managing Partner

Cybersecurity

Swift Service, Smiling Satisfaction

After a month of chasing cyber insurance quotes with no luck, Mitigata came through for us in just six days! They turned a frustrating process into a walk in the park, keeping us in the loop with speedy updates and stellar service. Now, we’re not just covered; we're covered with a smile. Big cheers to Mitigata for making our insurance experience a fairy tale ending!

CEO

Fintech

Exceeding Expectations with Excellence

Wow! Fast, friendly, and fiercely effective—that's how we'd describe our experience with Mitigata. After using their antivirus, ISO 27001 and other services, Mitigata exceeded our expectations with outstanding efficiency. We're not just satisfied—we're impressed and grateful for such reliable cybersecurity support.

CEO

IT/ITES

Compliance Made Comfortable

Mitigata has revolutionized our approach to compliance. Their easy connectivity and seamless service integration were impressive. Thanks to their fast processing, compliance is no longer a bottleneck for us. Exceptional service, highly recommended!

CEO

Enterprise Solutions

Safeguarding Confidence

Mitigata's Cyber Insurance and Professional Indemnity coverages have become pillars of trust for our team. In one instance, when a security incident nearly disrupted operations, the coverage and quick response we received kept us on track. Mitigata Console is our silent protector, alerting us to threats before they become problems. We can now move forward confidently, knowing that Mitigata has our back, come what may.

CTO

Fintech

Security Standards Reimagined

With Mitigata's help, we achieved ISO 27001 certification, and the impact on our operational security was immediate. Stakeholder confidence soared, and we saw a marked improvement in internal processes. Mitigata’s policy solutions also offer robust protection tailored to our dynamic needs in the tech sector. This journey with Mitigata has truly set us apart in security and operational resilience.

Compliance Officer

Information Technology

Ensuring Excellence in Liability

Mitigata’s PI and D&O insurance policies have been indispensable in helping us navigate complex liability scenarios. We faced a significant client situation recently, and thanks to their PI coverage, we were able to handle it without concern for unforeseen risks. Mitigata has proven to be a reliable partner in supporting both our reputation and our executives, ensuring we are always prepared for the unexpected.

Managing Partner

Cybersecurity

Swift Service, Smiling Satisfaction

After a month of chasing cyber insurance quotes with no luck, Mitigata came through for us in just six days! They turned a frustrating process into a walk in the park, keeping us in the loop with speedy updates and stellar service. Now, we’re not just covered; we're covered with a smile. Big cheers to Mitigata for making our insurance experience a fairy tale ending!

CEO

Fintech

How We Help You Protect Against

Cyber Threats

For Businesses

Grow your business with Active Insurance. We tackle cyber threats by combining security technology, insurance, and expert support for comprehensive protection.

For Executives

Strengthen your leadership with Active Insurance. We provide security tech, insurance, and specialized support to address executive-level digital risks.

For Individuals

Protect your digital life with Active Insurance. Our solution offers advanced security, insurance coverage, and personal support to keep you safe.

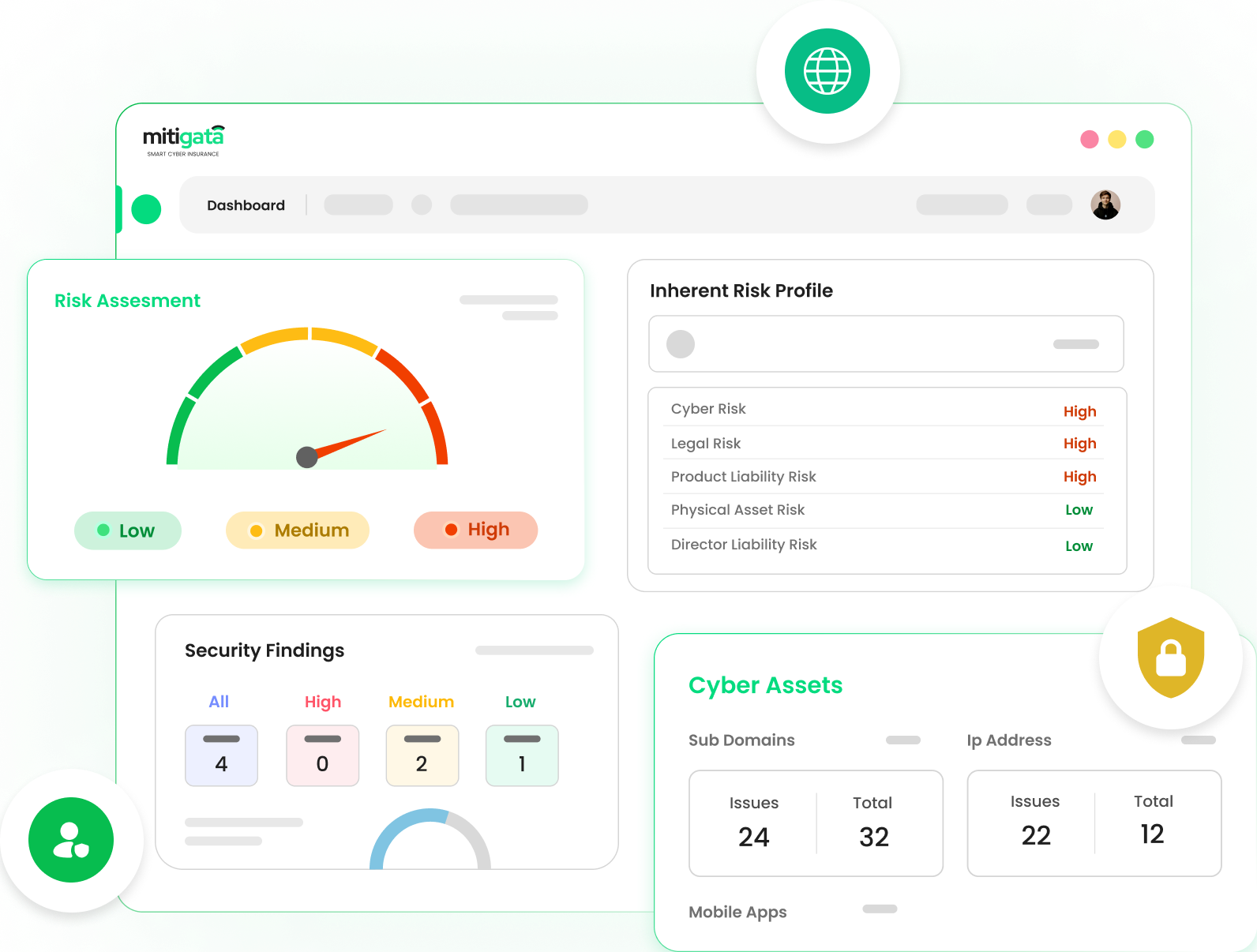

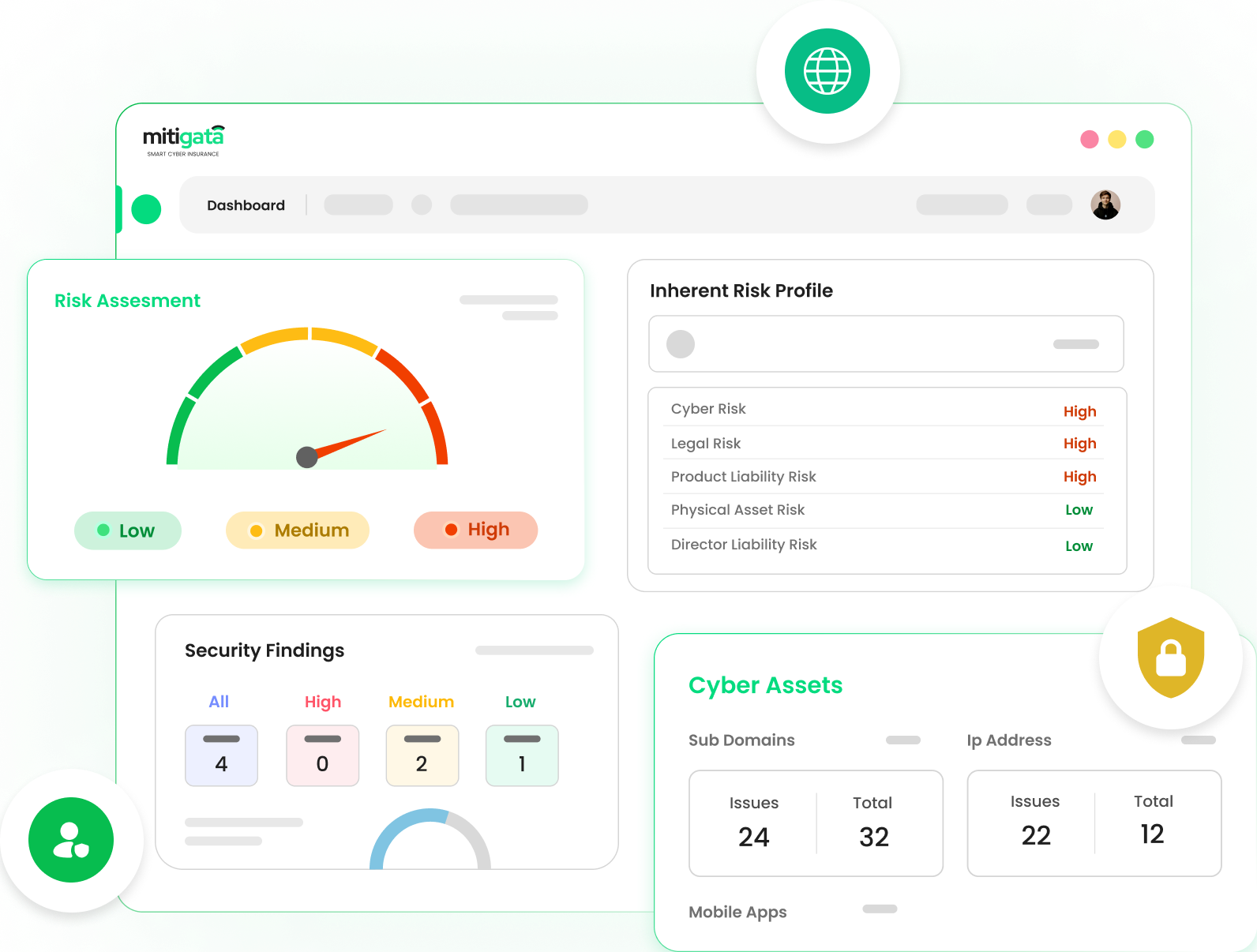

Mitigata ConsoleFeatures

Dashboard

- Real-time Monitoring: Continuously tracks and updates the organisation's cyber risk profile in real-time, allowing for immediate detection of potential threats.

- Customizable Views: Offers customizable dashboard views to cater to the specific needs and preferences of different users within the organisation, ensuring relevant data is always front and centre.

- Continuously tracks and updates the organisation's cyber risk profile in real-time, allowing for immediate detection of potential threats.

- Offers customizable dashboard views to cater to the specific needs and preferences of different users within the organisation, ensuring relevant data is always front and centre.

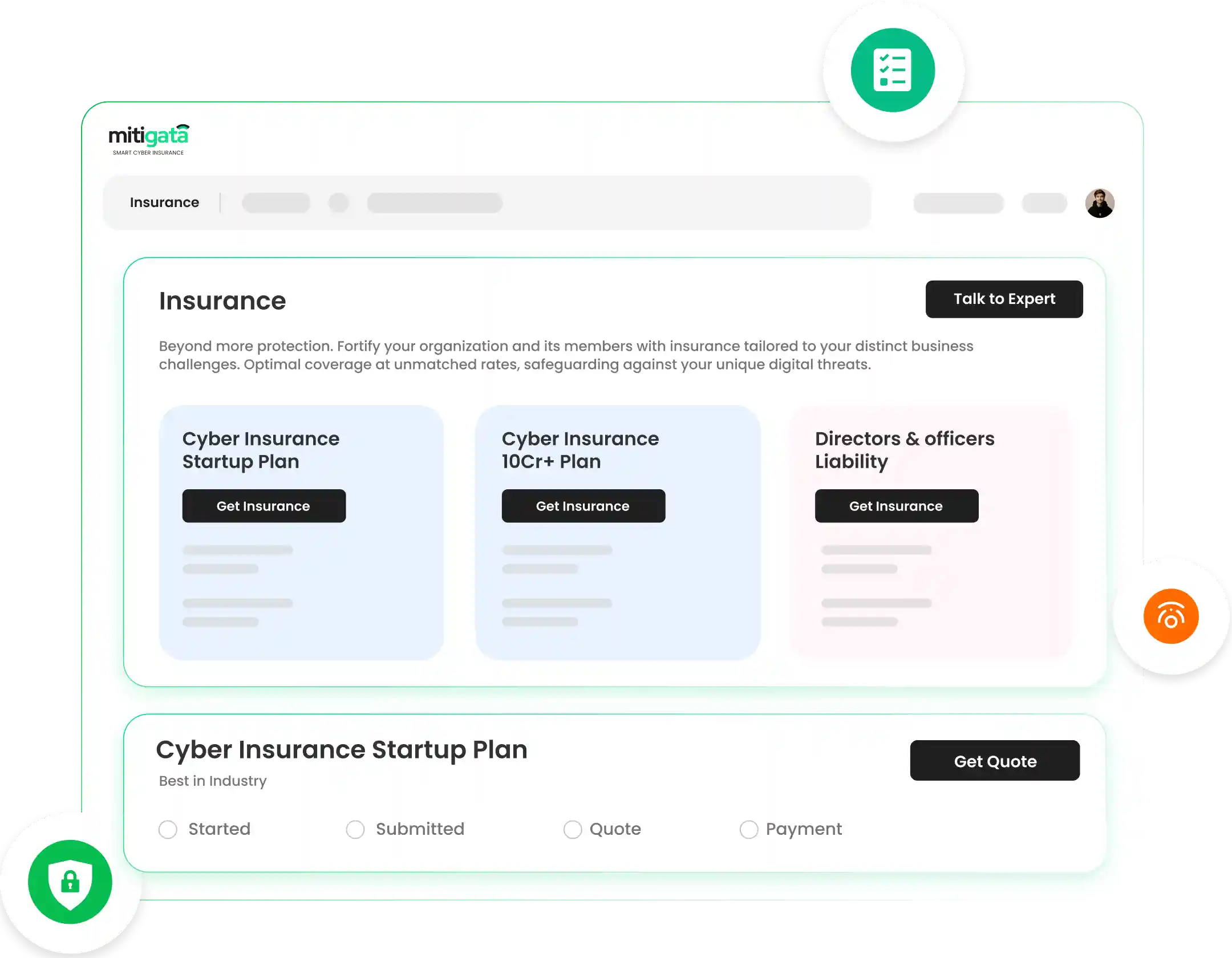

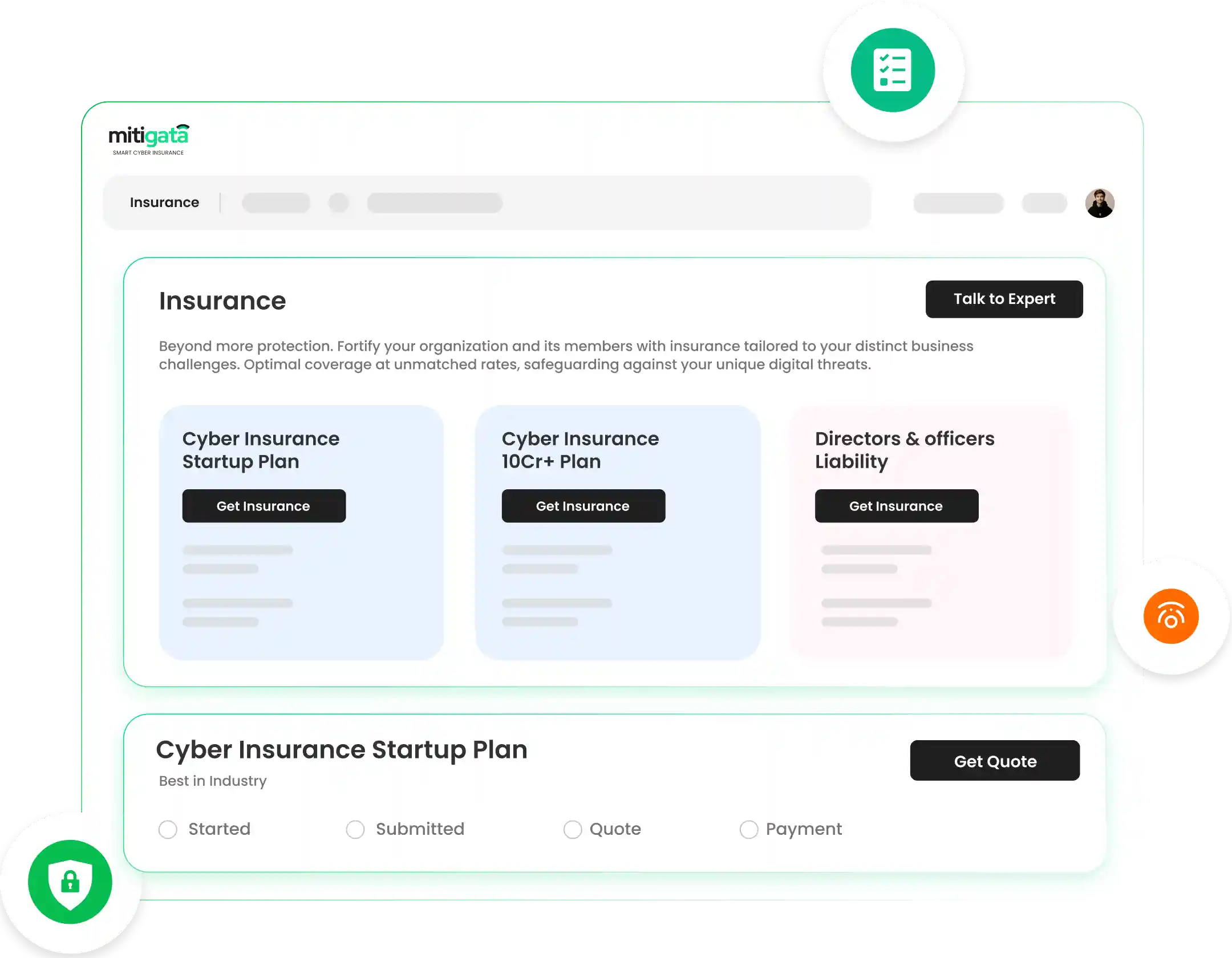

Insurance

- Immediate Quote Generation: Users can get insurance quotes instantly, simplifying the decision-making process for cyber insurance coverage.

- Transparent Claims Tracking: Offers a clear and straightforward tracking system for claims, providing updates at each stage until resolution.

- Users can get insurance quotes instantly, simplifying the decision-making process for cyber insurance coverage.

- Offers a clear and straightforward tracking system for claims, providing updates at each stage until resolution.

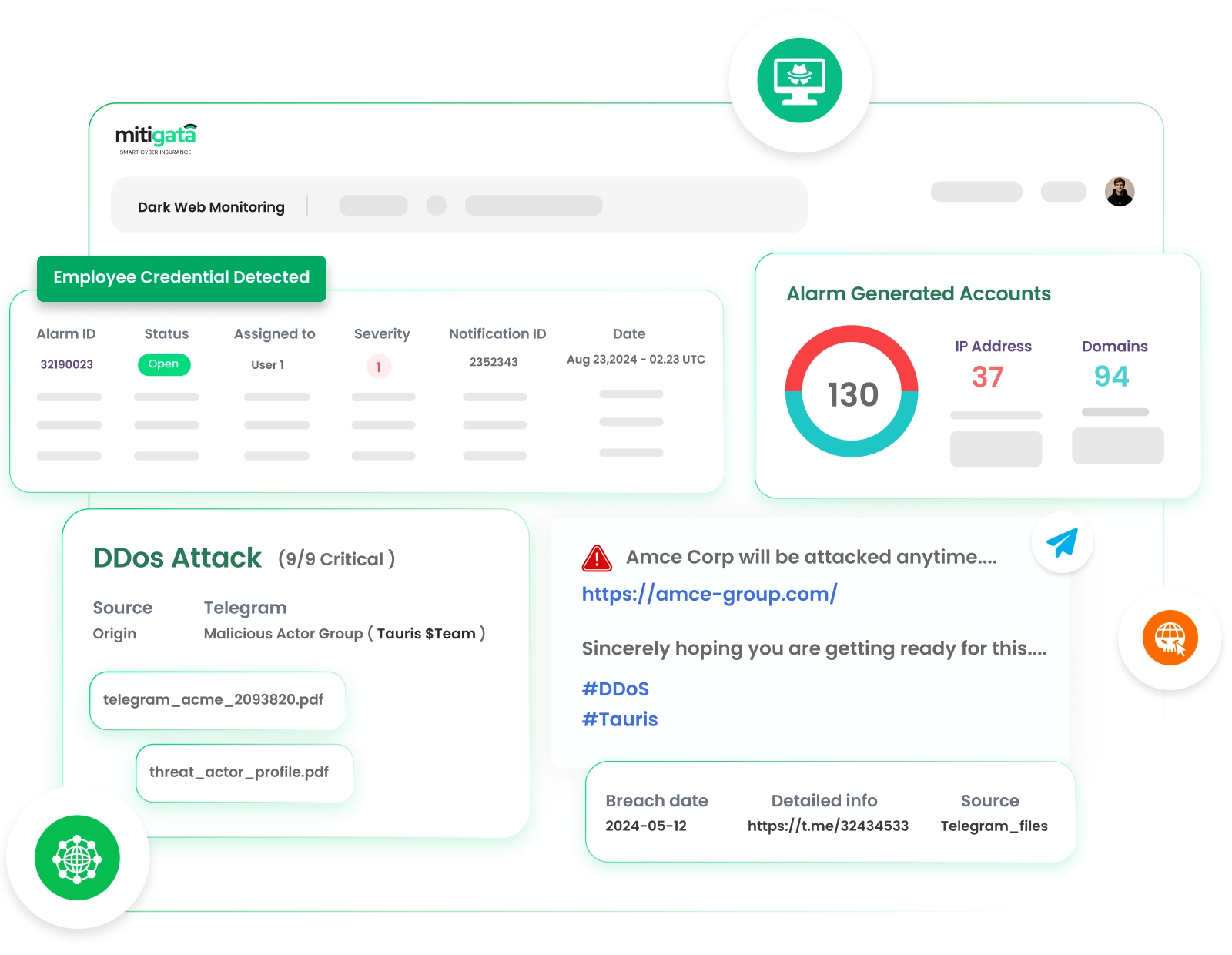

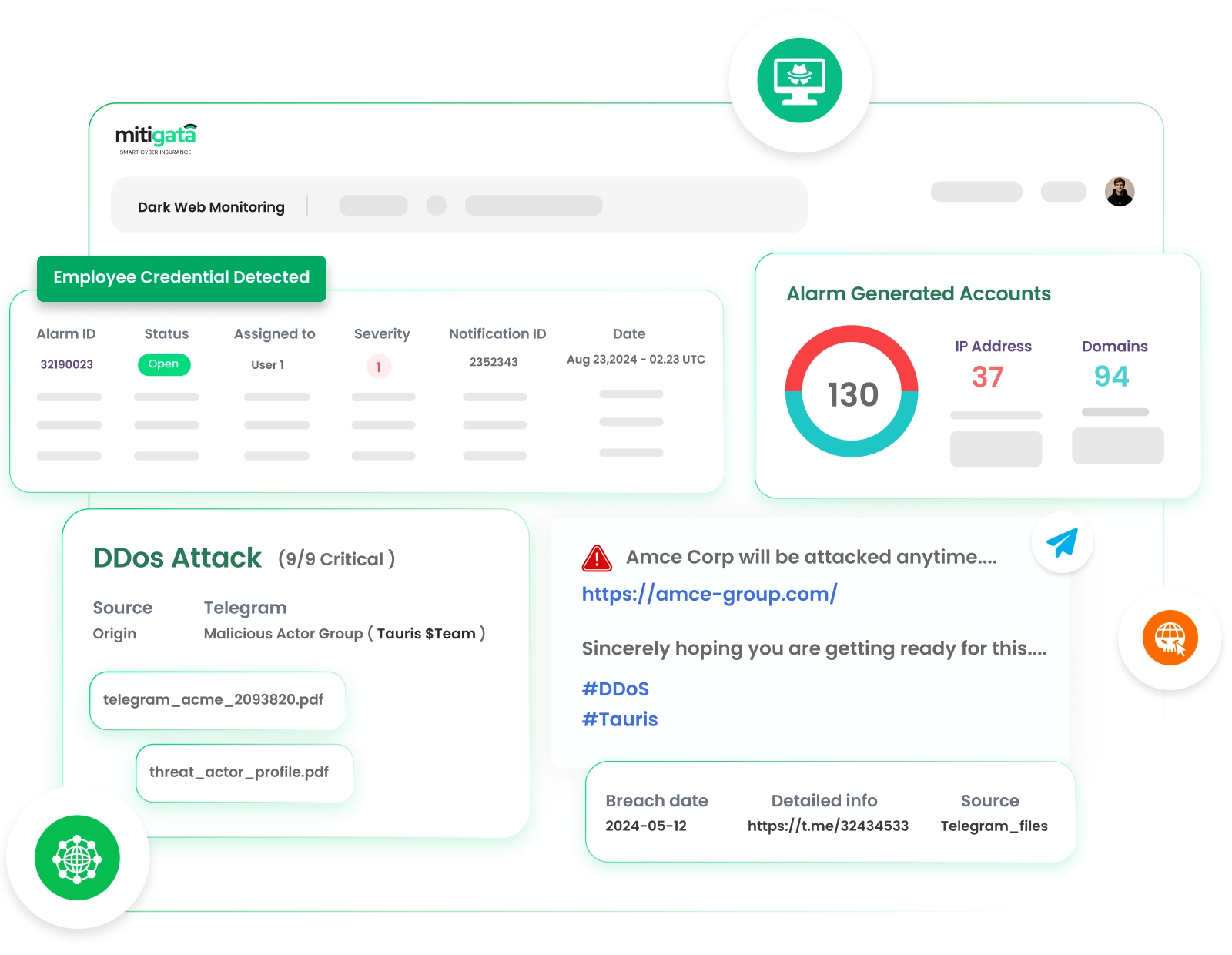

Detect the Undetected

- Real-Time Breach Detection: Continuously scans dark web forums, marketplaces, and encrypted platforms for leaked credentials, sensitive data, and stolen organizational information.

- Actionable Threat Alerts: Receive timely notifications whenever your organization's data or identifiers are found on the dark web.

- Tailored Risk Insights: Define specific keywords, domains, or identifiers unique to your business. Access detailed reports and actionable intelligence to identify vulnerabilities and safeguard your organization from emerging threats.

- Continuously scans dark web forums, marketplaces, and encrypted platforms for leaked credentials, sensitive data, and stolen organizational information.

- Receive timely notifications whenever your organization's data or identifiers are found on the dark web.

- Define specific keywords, domains, or identifiers unique to your business. Access detailed reports and actionable intelligence to identify vulnerabilities and safeguard your organization from emerging threats.

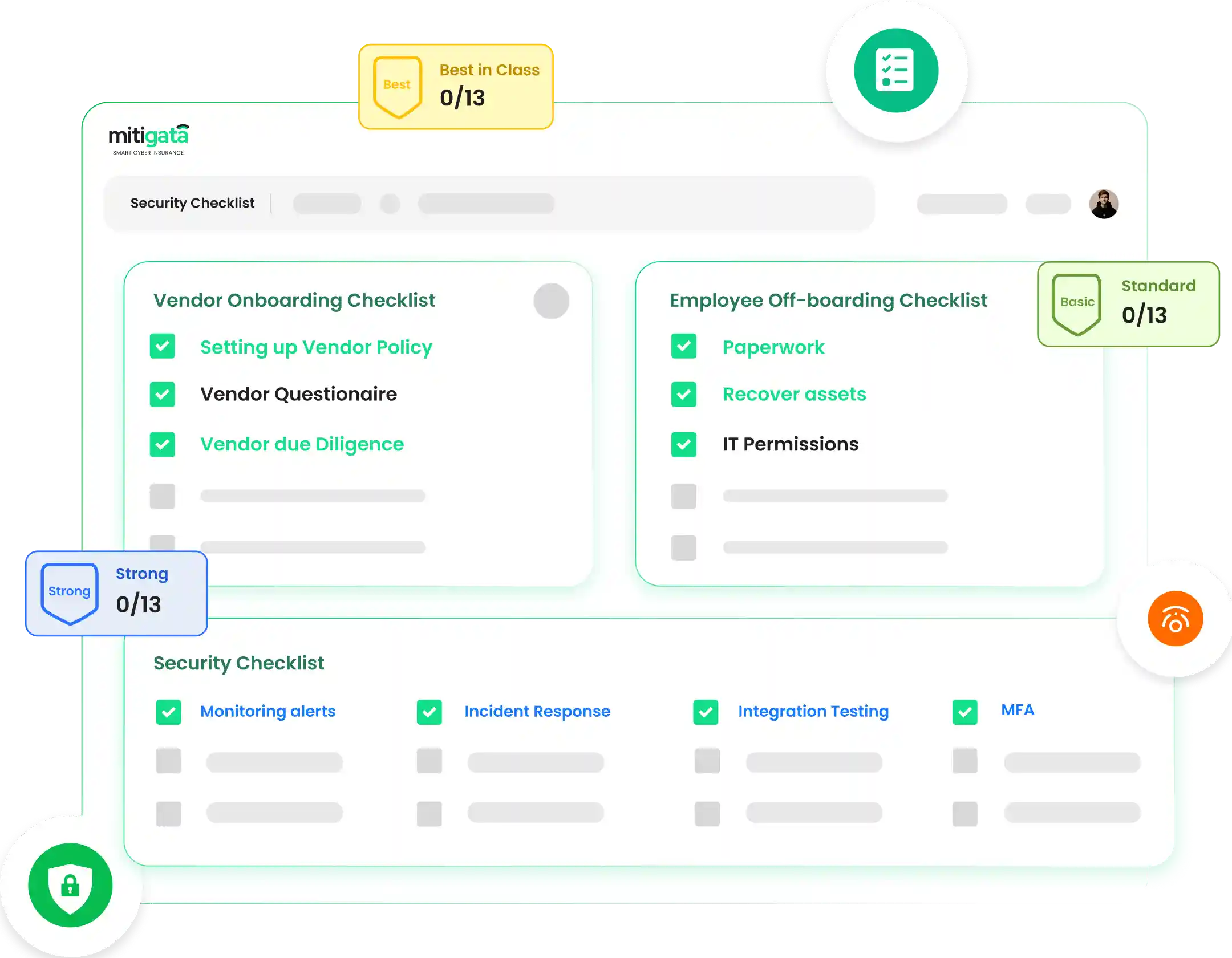

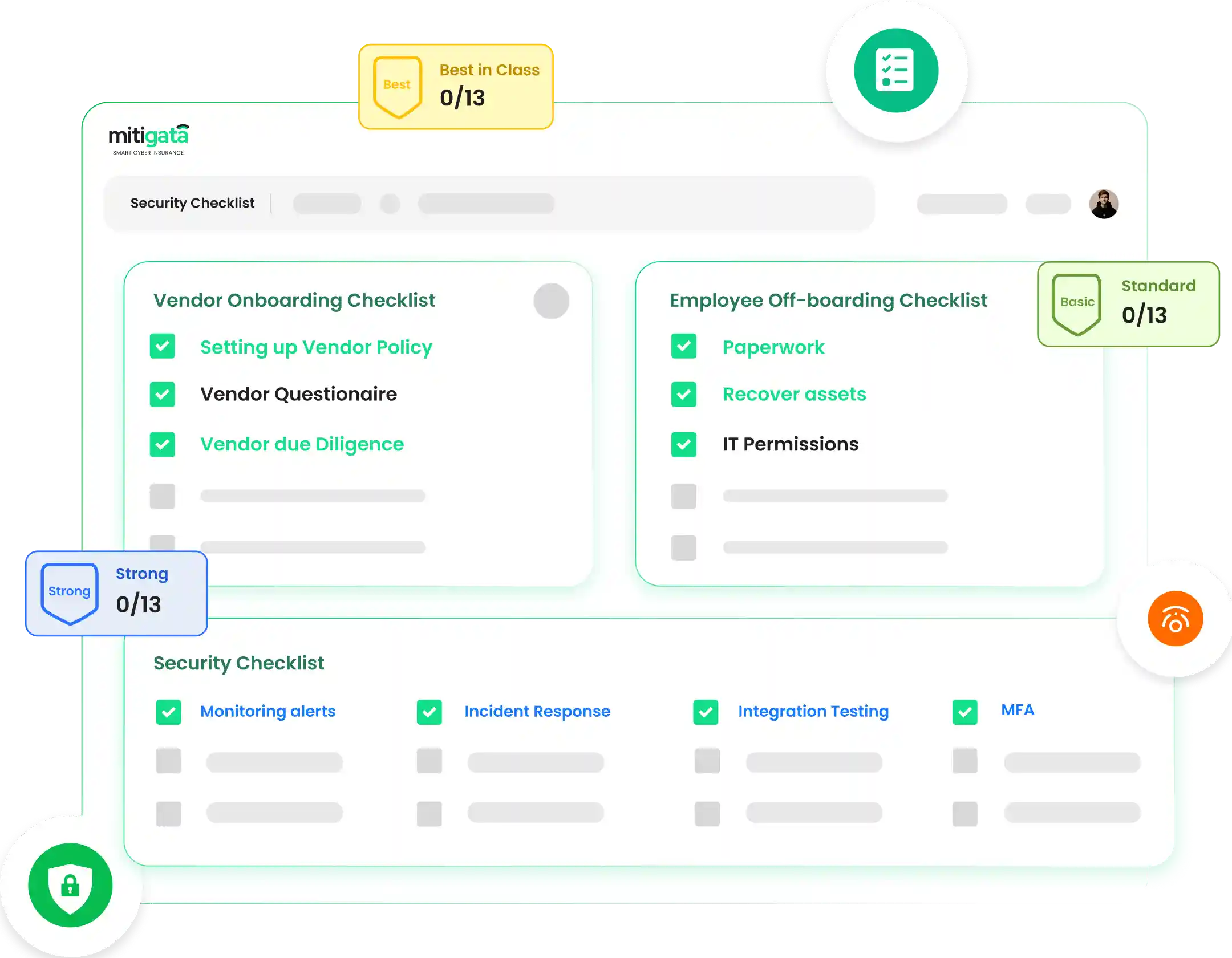

Security Checklist

- Automated Updates: Users can get insurance quotes instantly, simplifying the decision-making process for cyber insurance coverage.

- Customizable Tasks: Allows organisations to customise the checklist to fit their specific security requirements and priorities.

- Users can get insurance quotes instantly, simplifying the decision-making process for cyber insurance coverage.

- Allows organisations to customise the checklist to fit their specific security requirements and priorities.

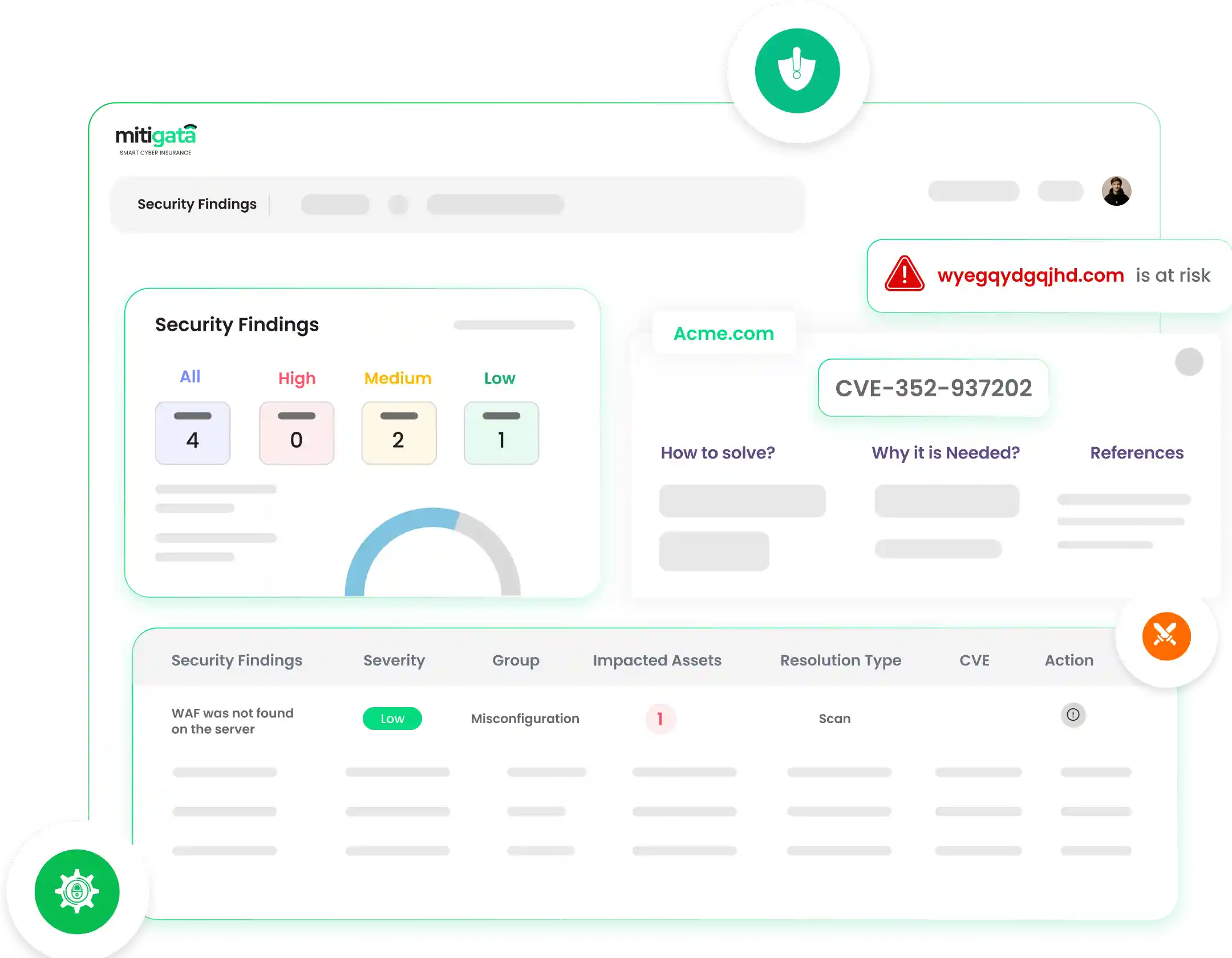

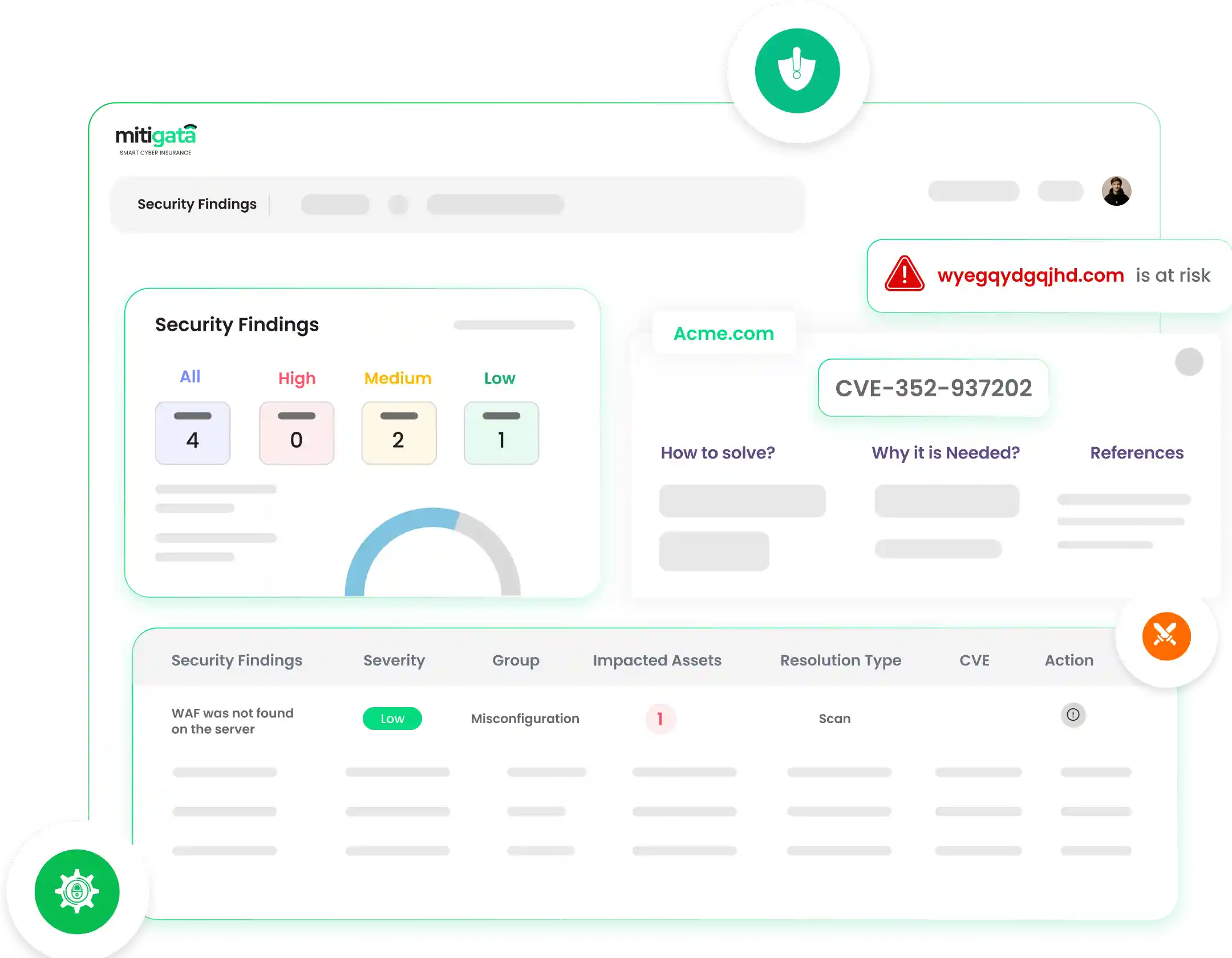

Security Findings

- Severity Ratings: Classifies findings by severity levels, enabling users to focus on the most critical issues first.

- Integration with Remediation Tools: Offers seamless integration with third-party remediation tools for efficient issue resolution.

- Classifies findings by severity levels, enabling users to focus on the most critical issues first.

- Offers seamless integration with third-party remediation tools for efficient issue resolution.

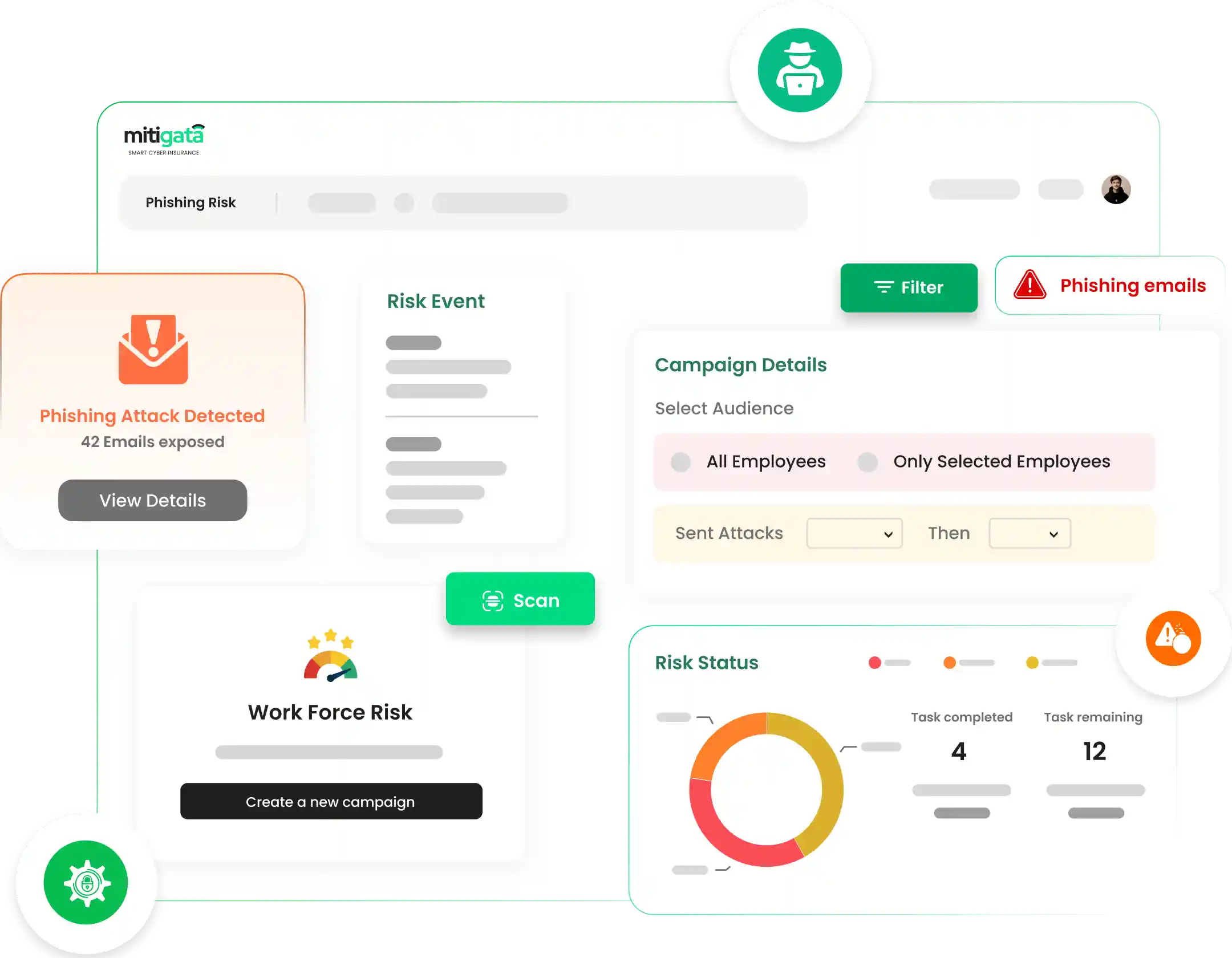

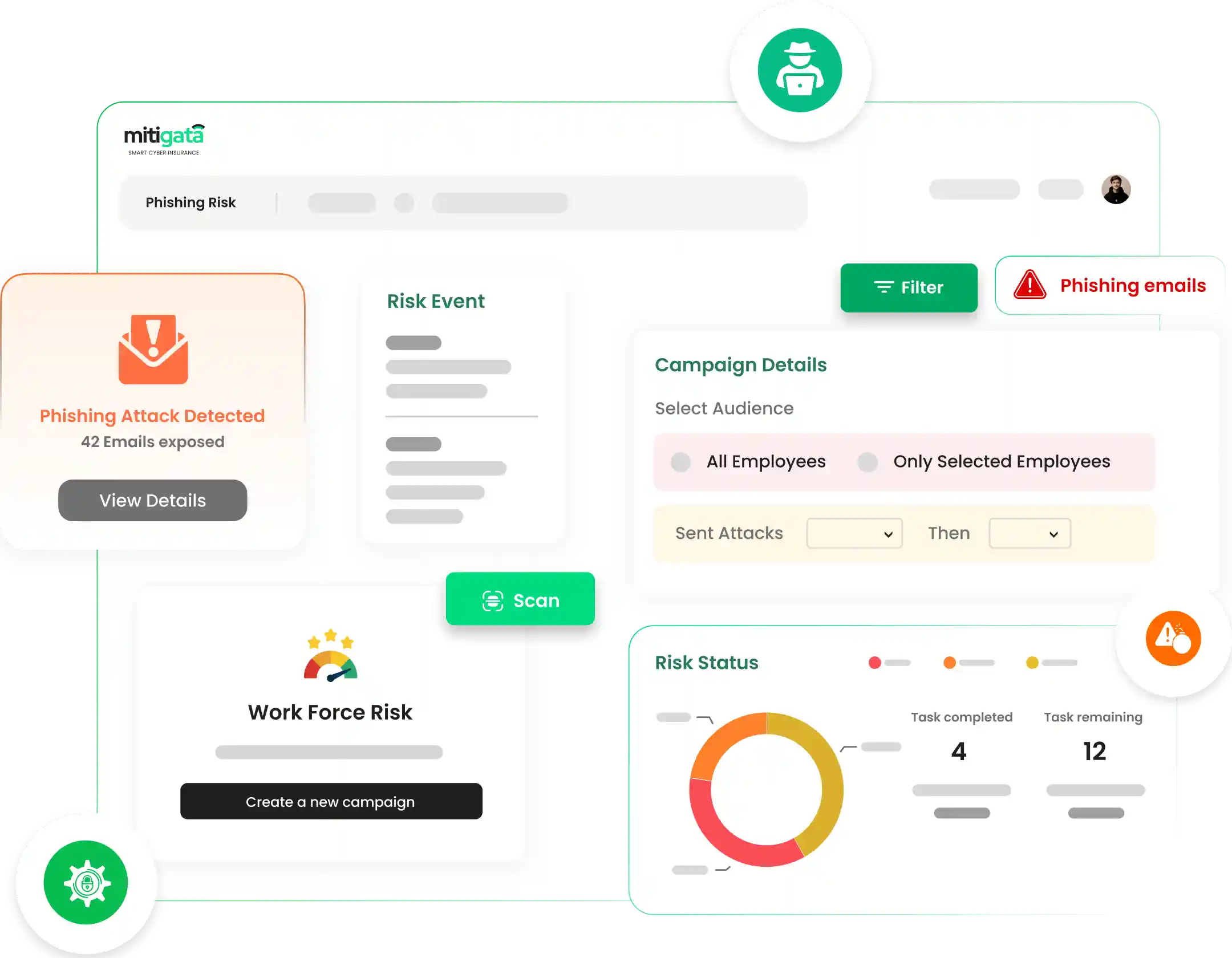

Phishing Risk

- Automated Alerts: Sends real-time alerts for newly identified phishing risks, minimising the window of opportunity for attackers.

- Educational Resources: Provides access to training and resources to help employees recognize and avoid phishing attempts.

- Sends real-time alerts for newly identified phishing risks, minimising the window of opportunity for attackers.

- Provides access to training and resources to help employees recognize and avoid phishing attempts.

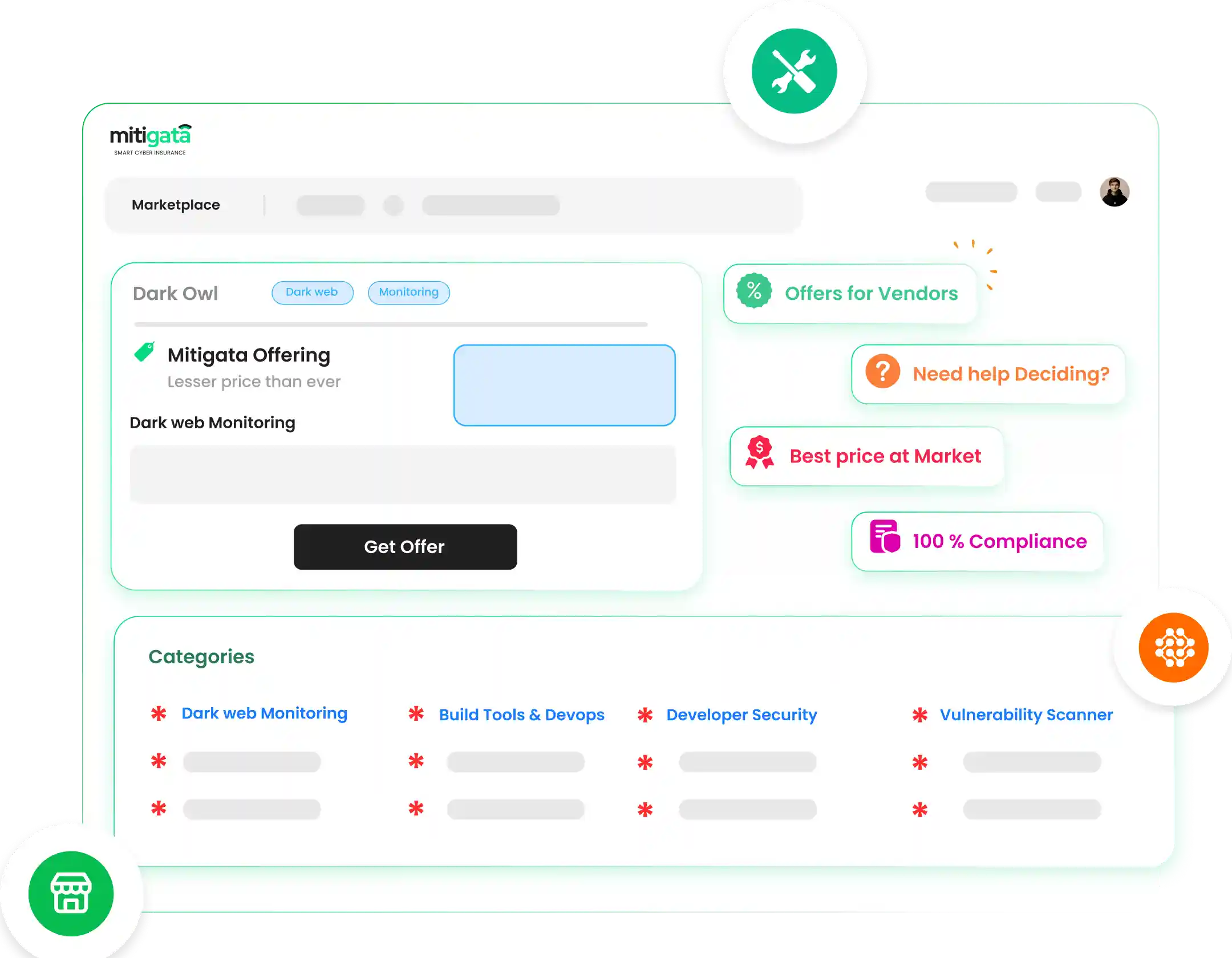

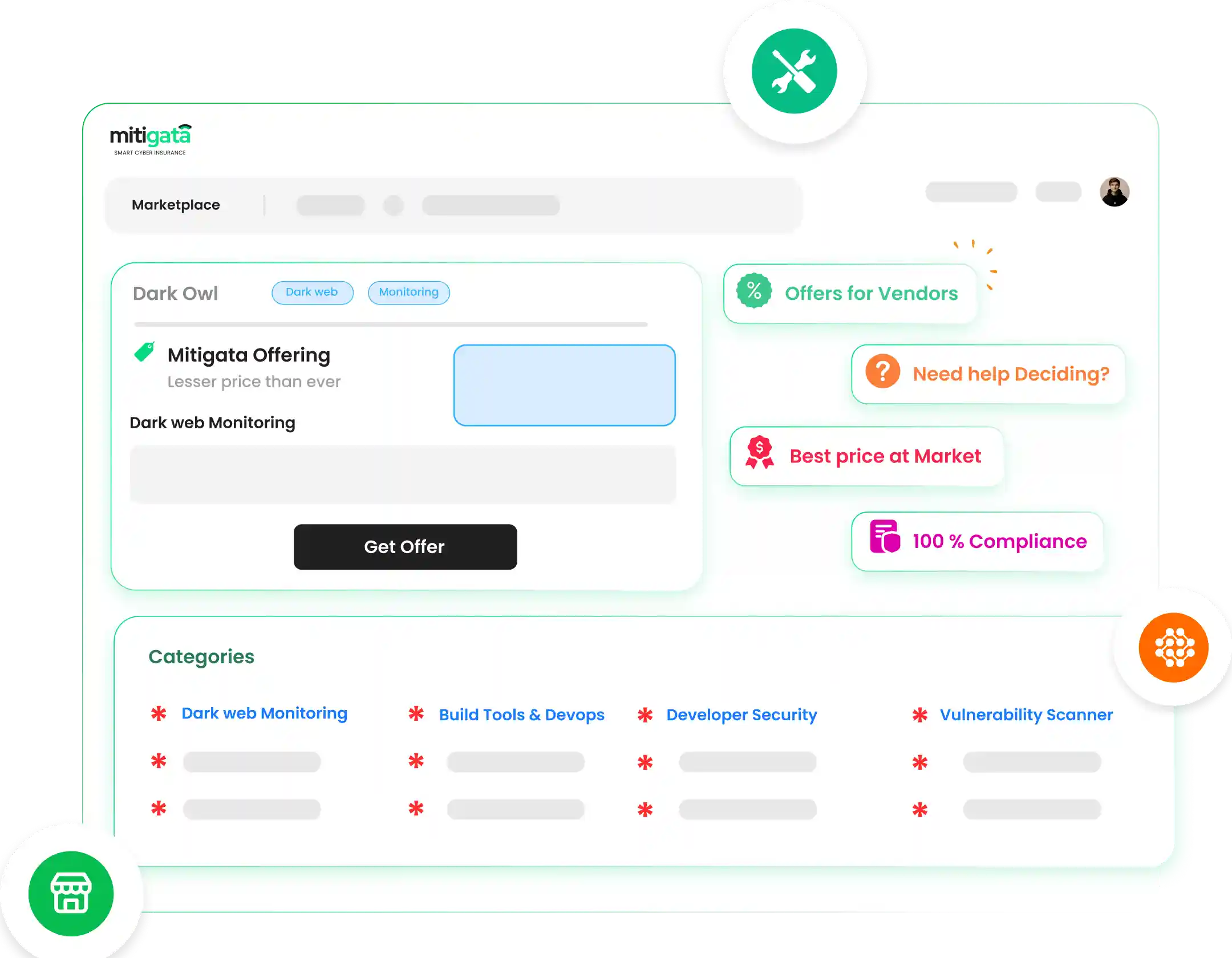

Marketplace

- Peer Reviews and Ratings: Includes user reviews and ratings for each cybersecurity solution, aiding in informed decision-making.

- Trial Offers: Many solutions come with trial offers or demos, allowing users to assess suitability before making a purchase.

- Includes user reviews and ratings for each cybersecurity solution, aiding in informed decision-making.

- Many solutions come with trial offers or demos, allowing users to assess suitability before making a purchase.

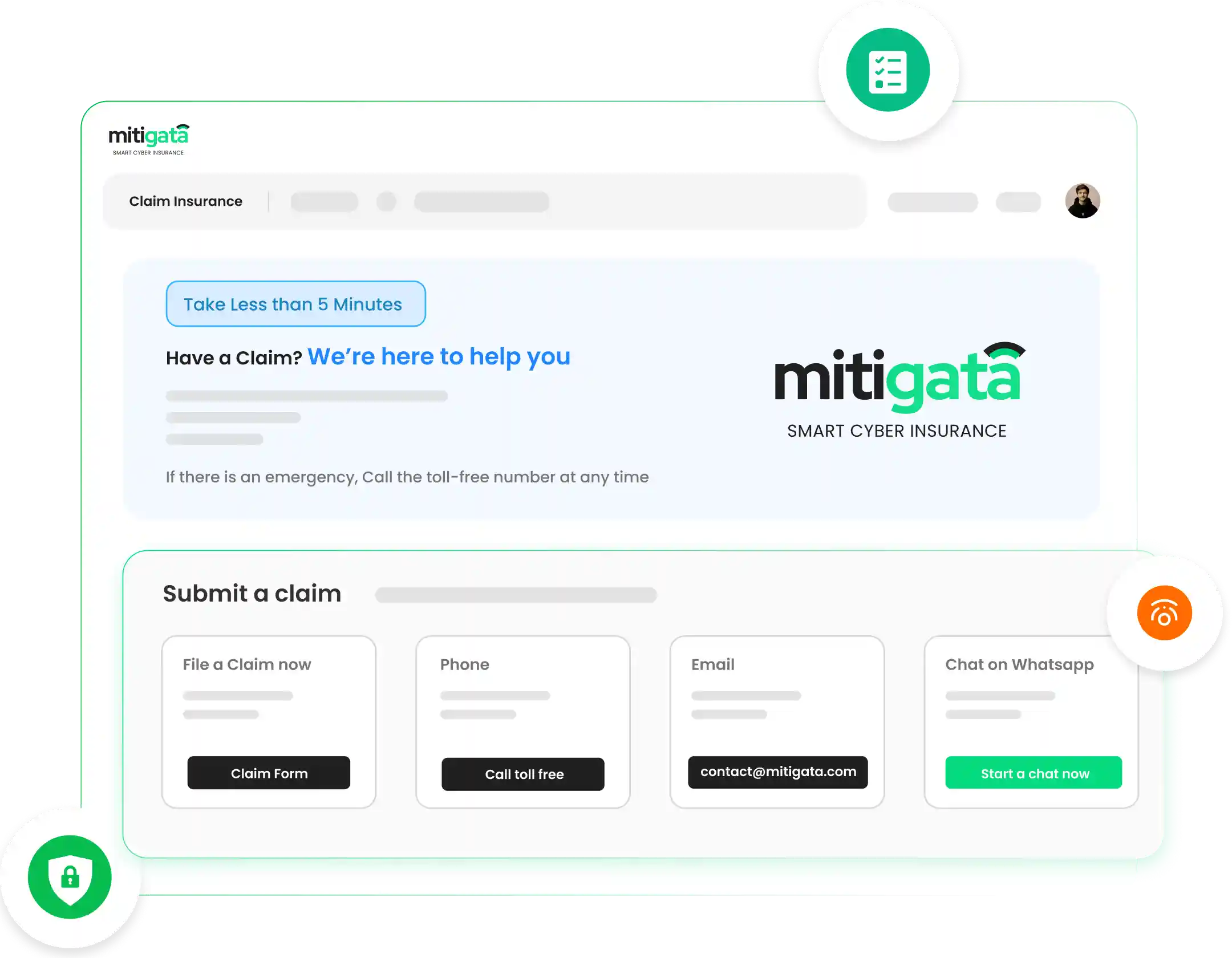

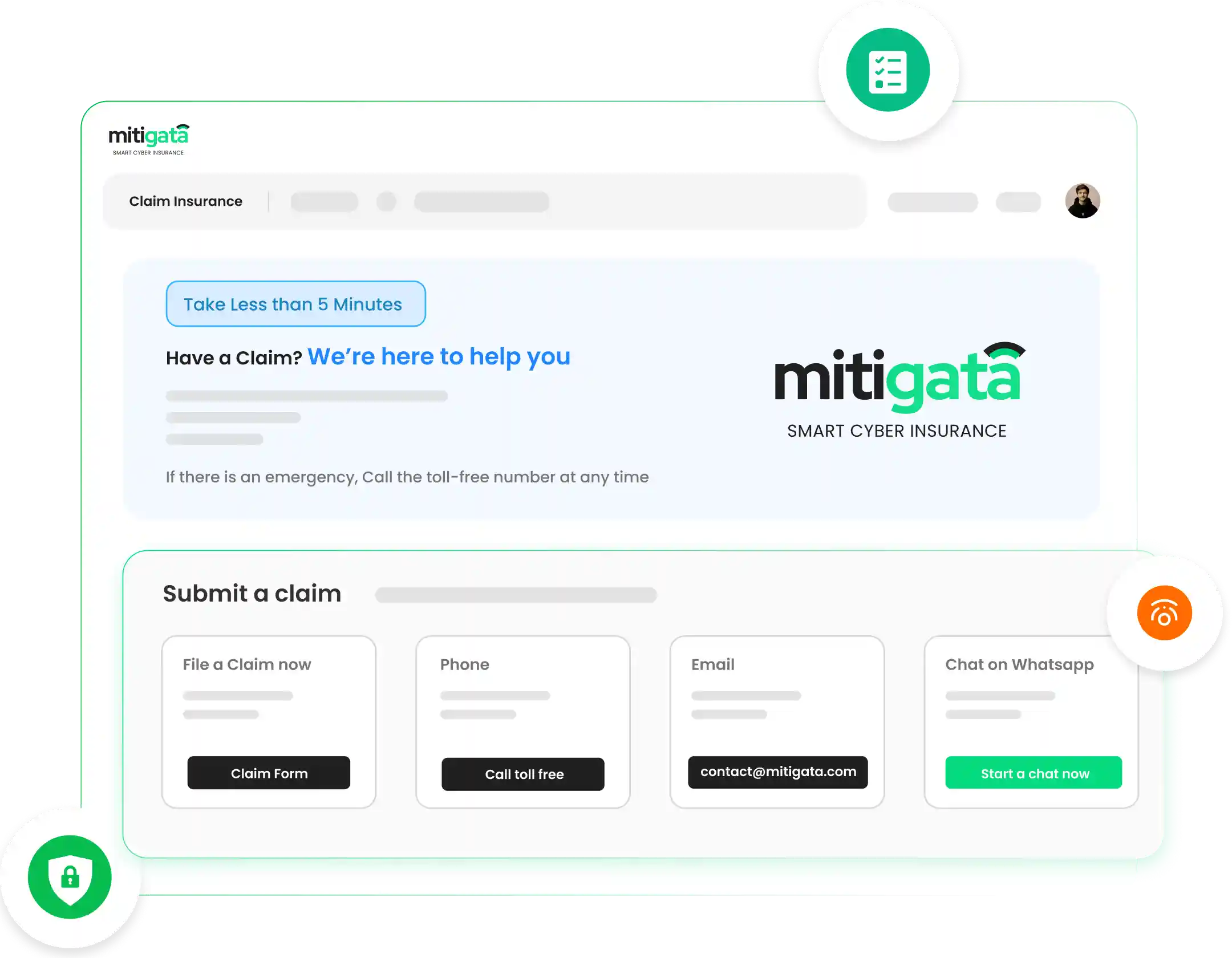

Claim Insurance

- Simplified Documentation Process: Streamlines the documentation process, making it easier for users to submit the necessary information.

- Expert Support: Offers direct access to insurance claim experts for personalised guidance and support.

- Streamlines the documentation process, making it easier for users to submit the necessary information.

- Offers direct access to insurance claim experts for personalised guidance and support.

Understanding the Cost of Cyber Attacks: A Financial Analysis

Explore the financial fallout of cyberattacks in India with Mitigata's Understanding the Cost of Cyber Attacks: A Financial Analysis Report. This crucial study delves deep into the escalating costs of cyber incidents, offering a detailed examination of their impact across various sectors. Discover the importance of cyber insurance and gain insights from real-world case studies that highlight the immediate and long-term economic consequences. Equip your organization with the knowledge to mitigate risks in today's increasingly vulnerable digital landscape.

Help Protect Your Business With Comprehensive

Cyber Coverage & Security Tools

Things You

Probably Wonder

Cyber insurance is a specialised insurance policy designed to protect businesses from financial losses resulting from cyber attacks, data breaches, and other cyber-related incidents. It provides coverage for expenses such as legal fees, customer notifications, credit monitoring services, and more.

You should buy cyber insurance to mitigate the financial impact of cyber threats on your business. Cyber attacks can lead to significant costs, including legal fees, regulatory fines, customer notifications, and reputational damage. Cyber insurance provides financial protection and helps businesses recover from cyber incidents more quickly.

Any business that relies on digital technology, stores sensitive data, or conducts transactions online can benefit from cyber insurance. This includes businesses of all sizes and across various industries, including retail, finance, healthcare, and more.

The cost of cyber insurance varies depending on factors such as the size and industry of your business, the level of coverage you need, and your risk profile. On average, cyber insurance premiums can range from a few thousand dollars to tens of thousands of dollars per year.

Yes, cyber insurance is worth it for small businesses. Small businesses are increasingly targeted by cybercriminals due to their perceived vulnerabilities and lack of robust cybersecurity measures. A cyber attack can have devastating financial consequences for small businesses, making cyber insurance an essential investment to protect against such risks. While the cost of cyber insurance may seem significant, it is far less than the potential costs of dealing with a cyber incident without insurance coverage.