Meeting regulatory demands in the context of cyber insurance compliance is increasingly becoming a pivotal concern for businesses across the globe. As cyber threats evolve in sophistication and frequency, organisations are seeking robust cyber insurance policies to mitigate financial risks associated with data breaches, cyberattacks, and other online threats.

However, navigating the intricate landscape of cyber insurance requires not only understanding the risks but also adhering to stringent compliance guidelines. This blog post delves into the essentials of cyber insurance compliance, providing businesses with the insights needed to navigate these complex waters.

The Rising Tide of Cyber Threats

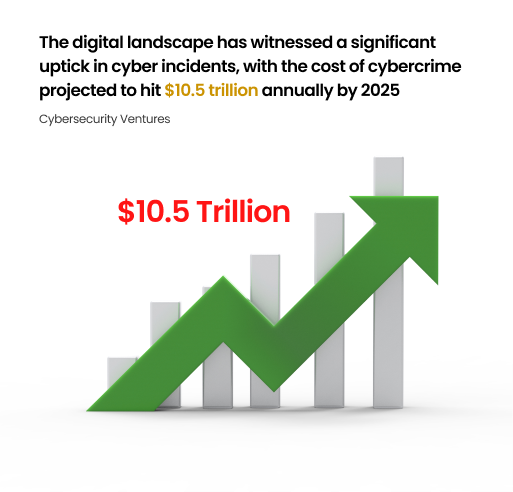

In recent years, the digital landscape has witnessed a significant uptick in cyber incidents, with the cost of cybercrime projected to hit $10.5 trillion annually by 2025, according to a report by Cybersecurity Ventures.

This surge underscores the critical importance of cyber insurance as a component of an organisation’s risk management strategy.

Yet, securing cyber insurance is no longer a straightforward task; insurers are now demanding comprehensive cybersecurity measures as a prerequisite for coverage.

This shift is a direct response to the escalating severity and frequency of cyber threats, highlighting the need for businesses to align their cybersecurity practices with industry standards and regulatory requirements.

Understanding Cyber Insurance Compliance

1. The Role of Compliance in Cyber Insurance

Compliance plays a dual role in the context of cyber insurance. Firstly, it acts as a gatekeeper, determining eligibility and influencing the terms and cost of coverage.

Insurers assess an organisation’s adherence to cybersecurity standards as part of the underwriting process, evaluating the risk profile and adjusting policies accordingly. Secondly, compliance serves as a roadmap for enhancing cybersecurity measures, guiding businesses in implementing best practices to mitigate risks effectively.

Quick Read: Meeting Regulatory Demands: Cyber Insurance Compliance Guidelines.

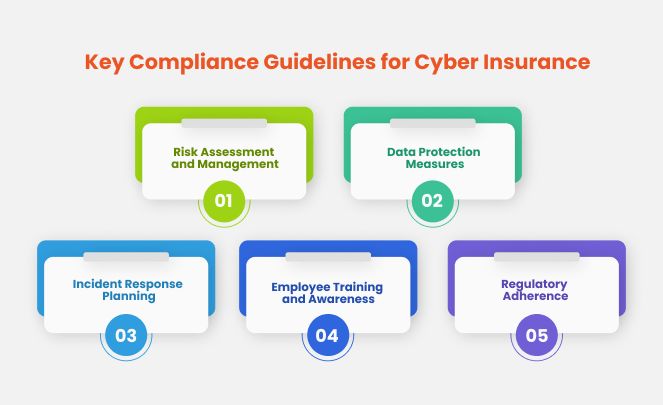

2. Key Compliance Guidelines for Cyber Insurance

- Risk Assessment and Management: Conducting regular risk assessments to identify and prioritise threats, followed by implementing strategic measures to mitigate these risks.

- Data Protection Measures: Adopting robust data encryption, access control, and data backup solutions to safeguard sensitive information against breaches and unauthorised access.

- Incident Response Planning: Developing a comprehensive incident response plan that outlines procedures for addressing cyber incidents, minimising damages, and facilitating recovery.

- Employee Training and Awareness: Implementing ongoing cybersecurity training programs to equip employees with the knowledge and tools needed to recognize and prevent cyber threats.

- Regulatory Adherence: Ensuring compliance with relevant data protection and cybersecurity regulations, such as GDPR, CCPA, and HIPAA, which can significantly influence cyber insurance requirements.

Navigating the Compliance Landscape

Achieving compliance with cyber insurance guidelines requires a strategic approach. Organisations should start by conducting a thorough audit of their current cybersecurity practices and policies, identifying gaps and areas for improvement.

Collaboration with cybersecurity experts and legal advisors can provide valuable insights into regulatory requirements and industry standards. Additionally, investing in cybersecurity technologies and services, such as firewalls, antivirus software, and managed security services, can enhance an organisation’s security posture and compliance status.

With Mitigata’s expertise in compliance solutions and cyber insurance, businesses can access tailored advice, advanced strategies, and support systems designed to streamline their compliance journey.

Leveraging Mitigata’s comprehensive suite of services not only accelerates the path to compliance but also enhances your cybersecurity posture, ensuring that your organisation is well-equipped to face the cyber challenges of today and tomorrow.

Trust Mitigata to be your guide and protector in the ever-evolving world of cyber threats, securing your digital assets and empowering your business towards a secure, compliant, and insured future.