“Compliance is not just about avoiding fines; it’s about building a framework that respects user privacy and ensures data integrity.” — Forbes, 2022. Compliance with regulatory standards is not just a legal obligation—it’s a critical component of building trust and maintaining a reliable reputation in data management. As digital threats become more sophisticated and pervasive, the role of cyber insurance in a comprehensive risk management strategy becomes increasingly important. Cyber insurance doesn’t just offer financial recovery from cyber incidents; it also plays a pivotal role in reinforcing a company’s compliance framework by aligning with and supporting global regulatory requirements.

The Role of Cyber Insurance in Compliance

Cyber insurance is instrumental in helping businesses navigate the often complex and stringent landscape of regulatory compliance. By providing coverage that mitigates losses from cyber incidents, cyber insurance also supports adherence to laws and regulations that govern data protection worldwide. This includes major frameworks like the General Data Protection Regulation (GDPR) in the European Union and the California Consumer Privacy Act (CCPA) in the United States, among others.

GDPR Compliance Support

The GDPR, which took effect in May 2018, has set a global benchmark for data protection by imposing strict guidelines on how businesses should handle the personal data of EU citizens. It emphasizes principles such as consent, right to access, data portability, and the right to be forgotten, pushing companies to revamp their data handling practices to ensure high levels of data privacy and security.

Cyber Insurance’s Role:

Cyber insurance aids in GDPR compliance by covering costs associated with data breaches, including legal fees, penalties, and expenses related to notifying affected individuals and regulators. It also provides access to expert resources to manage the aftermath of a breach effectively, ensuring that all measures are taken to mitigate further damage and comply with notification obligations under the GDPR.

CCPA Compliance Assistance

The CCPA, effective from January 2020, enhances privacy rights and consumer protection for residents of California. It grants consumers the right to know about the personal data collected on them, the right to request deletion of their data, and the right to opt-out of the sale of their personal information.

Cyber Insurance’s Role:

For businesses subject to the CCPA, cyber insurance can be an essential tool in managing the financial risks associated with non-compliance. Policies may include coverage for costs related to legal consultations, implementing privacy measures required by the CCPA, and handling consumer requests regarding their data rights. Additionally, insurers often provide proactive services to help insured entities comply with the CCPA, such as audits of privacy policies and practices, which can help prevent violations.

Understanding Regulatory Requirements

Meeting the requirements set by major regulations like the GDPR and CCPA involves significant operational and financial commitments. Non-compliance can lead to severe penalties, making it essential for businesses to fully understand and integrate compliance measures into their daily operations.

Key Regulations Explained

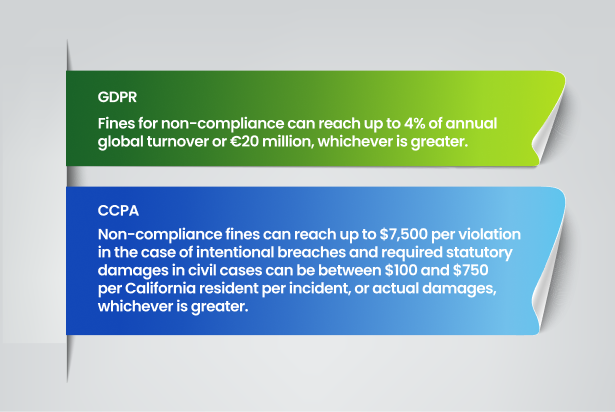

GDPR:

Under the GDPR, organizations must ensure that personal data is gathered legally and under strict conditions and that those who collect and manage it are obliged to protect it from misuse and exploitation, as well as to respect the rights of data owners. Fines for non-compliance can reach up to 4% of annual global turnover or €20 million, whichever is greater.

CCPA:

The CCPA provides California residents with rights similar to those in the GDPR but also includes specific provisions like the requirement for businesses to have a clear and accessible privacy policy that explains consumers’ rights and how to exercise them. Non-compliance fines can reach up to $7,500 per violation in the case of intentional breaches and required statutory damages in civil cases can be between $100 and $750 per California resident per incident, or actual damages, whichever is greater.

These regulatory frameworks underline the need for robust compliance strategies, underpinned by effective cyber insurance that not only mitigates the financial impact of non-compliance but also supports the ongoing adherence to these critical legal requirements.

Cyber Insurance and GDPR Compliance

Case Study: GDPR Fine Mitigation

In 2020, a notable incident involved British Airways, which faced a record fine of £183 million for a data breach that compromised the data of 500,000 customers. The fine was later reduced to £20 million due to mitigating factors, including the economic impact of COVID-19.

How Cyber Insurance Helped:

While the insurance may not cover the entire fine, having cyber insurance helped British Airways deal with direct costs related to the breach, such as customer notifications, legal fees, and enhanced security measures post-incident. These are typically covered under a comprehensive cyber insurance policy, which can also support businesses in demonstrating their commitment to implementing security measures, potentially influencing the reduction of fines.

Financial Support and Resources

Cyber insurance provides financial backing and access to specialized resources that are crucial in the immediate aftermath of a data breach, which can be pivotal in maintaining compliance during crises.

Immediate Response:

- Legal and forensic services: Insurance providers often have ties with law firms and forensic experts who specialize in data breaches and regulatory compliance, ensuring that the response is swift and compliant with legal requirements.

- Coverage of fines and penalties: While not all policies cover regulatory fines, many cyber insurance policies include coverage for defense costs associated with regulatory investigations.

Enhancing Compliance Through Cyber Insurance

Investing in cyber insurance can also preemptively enhance a company’s compliance posture by requiring them to meet certain cybersecurity standards to qualify for coverage.

Preventative Measures:

- Risk assessments: Many insurers require a thorough risk assessment before issuing a policy. This process helps identify vulnerabilities and enforce measures that comply with data protection regulations.

- Implementation of best practices: Insurers often provide guidelines or frameworks for what they consider industry best practices in data security, which typically align with regulatory expectations.

Real-Life Success Stories

Case Study: Compliance Support Post-Breach

A large healthcare provider in the U.S. suffered a data breach in 2019 that affected millions of records. The swift response, funded and guided by their cyber insurance, included customer notifications, free credit monitoring for affected individuals, and a comprehensive review of their systems. The proactive measures taken post-breach were favorably looked upon by regulators, significantly reducing potential penalties.

Mitigata: Your Partner in Cyber Insurance And Compliance

For businesses seeking to navigate the complexities of cyber compliance, Mitigata offers bespoke solutions that extend beyond traditional insurance.

We provide:

- Risk Assessment Tools: Tailored to help businesses identify potential compliance gaps.

- Expert Consultation: Access to cybersecurity and legal experts who specialize in data protection laws.

- Proactive Compliance Support: Guidance in implementing the necessary security measures to meet regulatory standards.

- Cyber Insurance Coverage: Tailored cyber insurance policies that help cover the financial ramifications of data breaches, support regulatory compliance efforts, and provide access to rapid response resources to manage and mitigate cyber incidents effectively.

Conclusion

Cyber insurance is more than a safety net for financial recovery; it’s a proactive tool that supports and enhances a company’s compliance efforts. By integrating cyber insurance into their risk management strategies, businesses not only safeguard themselves financially but also strengthen their compliance frameworks, thereby fostering trust and securing their reputation in the digital world.