On August 1, 2024, a ransomware attack crippled payment systems at nearly 300 small Indian banks, causing widespread disruption and financial loss. This blog explores the incident, cyber insurance, and next steps for banks and IT providers. We’ll cover the technical aspects, C Edge Systems’ role, the impact, and the importance of robust cyber insurance. By the end, you’ll understand the significance of cyber insurance and how Mitigata can help protect your business from similar threats.

What Happened?

In the early hours of August 1, 2024, a sophisticated ransomware attack targeted nearly 300 small Indian banks. Consequently, the attackers deployed malware to encrypt critical payment systems, demanding a hefty ransom in cryptocurrency to restore access. This incident disrupted banking operations, leaving thousands of customers unable to complete transactions or access their funds.

How C Edge Systems Was Used to Get into Banks

The attack was traced back to a vulnerability in the systems provided by C Edge Systems, a technology service provider to the banking sector. Therefore, the attackers exploited this vulnerability to gain unauthorized access and deploy the ransomware across multiple banks simultaneously. This breach underscores the crucial role of third-party vendors in cybersecurity and the need for stringent security measures and regular vulnerability assessments.

The Role of Cyber Insurance and Risk Transfer

Cyber Insurance in Action

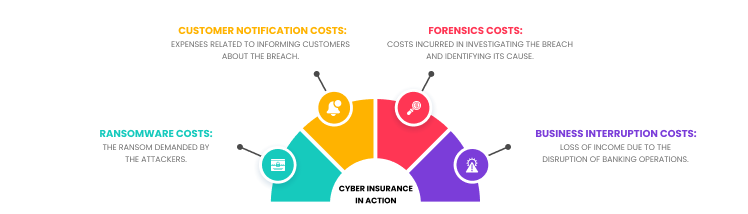

In this scenario, the banks’ cyber insurance policies will play a crucial role in mitigating the financial impact of the attack. Cyber insurance covers various costs associated with a ransomware attack, including:

- Ransomware Costs: The ransom demanded by the attackers.

- Customer Notification Costs: Expenses related to informing customers about the breach.

- Forensics Costs: Costs incurred in investigating the breach and identifying its cause.

- Business Interruption Costs: Loss of income due to the disruption of banking operations.

Simultaneously, Tech Errors & Omissions (Tech E&O) and Cyber Insurance policies of C Edge Systems will trigger. These policies cover the liability and financial losses associated with the breach, adding to the overall loss-sharing between multiple insurance policies.

The Impact of Not Having Cyber Insurance

If the banks or C Edge Systems did not have cyber insurance or Professional Indemnity (PI) policies, they would bear the full brunt of the financial losses. Consequently, this could amount to millions of dollars, potentially crippling their operations and reputation. The lack of insurance would also decrease their insurability in the future, leading to higher premiums and increased risk exposure.

Whom Does It Affect the Most?

Banks

Banks are at the forefront of the impact. They face financial losses, operational disruptions, and potential legal liabilities. Additionally, the trust and confidence of their customers are also at stake, which could lead to a loss of business and reputation damage.

B2B Companies Acting as Vendors/Solution Providers to Banks

Vendors and solution providers like C Edge Systems are also significantly affected. They face liability for the breach, potential lawsuits from their clients, and reputational damage. Moreover, the incident underscores the importance of having robust Tech E&O and cyber insurance policies to protect against such risks.

What to Do Next?

If You Are a Bank Affected by This Attack

- Contact Mitigata: For rapid forensics and claim response.

- Initiate Incident Response: Engage cybersecurity experts to contain the breach and prevent further damage.

- Notify Customers: Inform affected customers about the breach and the steps being taken to resolve it.

- Review Security Measures: Conduct a thorough review of your cybersecurity practices and implement necessary improvements.

If You Are a Bank Not Affected by This Attack and Have a Cyber Insurance Policy

- Get a Cyber Risk Assessment: Reassess your cyber risk and reverify your policy with Mitigata’s policy AI to ensure comprehensive coverage for scenarios like this.

- Enhance Security Measures: Strengthen your cybersecurity defenses and conduct regular vulnerability assessments.

If You Are a Bank Not Affected by This Attack and Do Not Have a Cyber Insurance Policy

- Get Cyber Insurance: Obtain the most optimized cyber insurance policy with Mitigata to protect against future threats.

- Implement Security Best Practices: Adopt robust cybersecurity measures and conduct regular training for your staff.

If You Are an IT Service Provider to Banks and Financial Institutions

- Get Cyber Insurance and Tech E&O Policies: Protect your business with comprehensive cyber insurance and Tech Errors & Omissions policies.

- Mandate Cyber Insurance for Vendors: Ensure that your vendors and suppliers have appropriate cyber insurance and PI policies in place.

The Importance of Cyber Insurance for Third-Party Services

Basically, for any organization using third-party services, it is imperative to mandate your vendors and suppliers to get cyber insurance and professional indemnity (Tech E&O) insurance. This ensures that any breach or attack affecting your third-party providers does not cripple your operations and financial stability.

How Mitigata Can Help

With Mitigata, businesses can relax and focus on running their operations while we help them with their insurance policies, assisting them in fighting attacks, getting claims, and improving their overall security posture. Mitigata offers a free risk assessment and a 30% discount on forensics and incident response for everyone affected by this attack.

Quick Read: E-commerce Client Recovers from Data Breach and Ransomware Attack.

Conclusion

The ransomware attack on Indian banks highlights the need for robust cybersecurity and comprehensive cyber insurance. For banks, IT providers, or any organization relying on third-party services, cyber insurance is essential against evolving threats.

Mitigata is committed to helping businesses navigate these challenges, providing tailored cyber insurance solutions, rapid incident response, and ongoing support to enhance your cybersecurity posture. So, don’t wait for an attack to happen—protect your business today with Mitigata.

Contact Us

For more information on how Mitigata can help you secure your business against cyber threats, visit our website or contact us today. Let’s fight this together!