“Nearly 1 in 4 fall victim to online shopping scams”. Shopping online offers unmatched convenience, allowing us to purchase almost anything from anywhere at any time. However, this ease of access also brings with it certain perils as cybercriminals constantly devise new ways to exploit unsuspecting shoppers. From enticing but deceptive offers to sophisticated phishing attacks, the threats are real and ever-present. This detailed exploration aims to delve into why it’s crucial for every online shopper to consider personal cyber insurance, supported by real-life examples of individuals who’ve encountered these cyber scams.

Common Cyber Risks for Online Shoppers

When you shop online, you expose yourself to several significant risks that could impact your financial health and personal security:

- Identity Theft: This occurs when your personal details are stolen and used fraudulently, which can result in financial loss, damage to your credit score, and a lengthy recovery process.

- Payment Fraud: Cyber thieves might use stolen credit card information or bank details to make unauthorized purchases or withdrawals, leaving you to deal with the financial repercussions.

- Phishing Scams: One of the most common tricks involves phishing, where scammers use fake emails or copycat websites pretending to be legitimate online retailers to steal personal information.

Real-Life Cyber Fraud Incidents in India

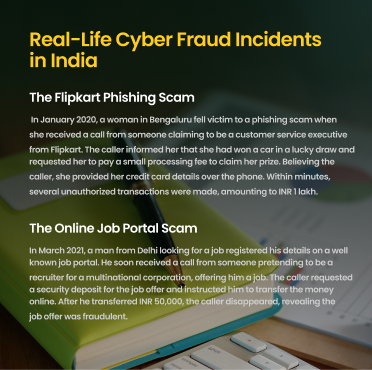

Case Study 1: The Flipkart Phishing Scam

Incident: In January 2020, a woman in Bengaluru fell victim to a phishing scam when she received a call from someone claiming to be a customer service executive from Flipkart. The caller informed her that she had won a car in a lucky draw and requested her to pay a small processing fee to claim her prize. Believing the caller, she provided her credit card details over the phone. Within minutes, several unauthorized transactions were made, amounting to INR 1 lakh.

Source: This incident was reported by several local newspapers in Bengaluru, highlighting how cybercriminals impersonate legitimate e-commerce platforms to commit fraud.

Case Study 2: The Online Job Portal Scam

Incident: In March 2021, a man from Delhi looking for a job registered his details on a well-known job portal. He soon received a call from someone pretending to be a recruiter for a multinational corporation, offering him a job. The caller requested a security deposit for the job offer and instructed him to transfer the money online. After he transferred INR 50,000, the caller disappeared, revealing the job offer was fraudulent.

Source: Delhi Police reported this incident, and it was covered by local media. This type of scam is common on job portals, where fraudsters exploit the desperation of job seekers.

Why Personal Cyber Insurance is Essential

Given the prevalence of these risks, having personal cyber insurance isn’t just helpful; it’s essential. Here’s how such insurance can protect you:

- Financial Protection: Cyber insurance can reimburse you for direct financial losses due to fraudulent transactions, helping you recover without bearing the cost alone.

- Identity Theft Protection: These policies often include services that monitor your personal information and alert you to potential misuse, plus help in recovering your identity if it’s been compromised.

- Legal and Expert Support: If you’re a victim of cyber fraud, navigating the aftermath can be daunting. Many cyber insurance policies provide access to legal advice and expert support, easing the burden during these challenging times.

Expanding Your Knowledge: More on Cyber Risks and Protections

Safe Shopping Practices

Enhancing your awareness of safe online shopping practices is the first line of defense:

- Use Secure Connections: Always ensure your internet connection is secure and avoid public Wi-Fi for transactions.

- Shop on Reputable Websites: Stick to well-known websites or thoroughly check the credibility of lesser-known ones before making purchases.

- Enable Strong Authentication: Use strong, unique passwords and enable two-factor authentication for added security on your accounts.

Understanding Cyber Insurance Coverage

It’s vital to understand what your cyber insurance covers:

- Scope of Coverage: Does it cover all forms of cyber fraud you might encounter while shopping online?

- Claim Process: Know how to file a claim and understand the documentation you need to provide, which is crucial when you’re stressed and dealing with fraud.

- Preventive Measures: Some insurers offer tools that help protect your personal data before an incident occurs, like virtual credit card services or real-time transaction alerts.

Conclusion: Mitigata – Your Shield Against Cyber Threats

Navigating the online marketplace requires more than just being cautious—it requires being prepared. Mitigata’s personal cyber insurance provides comprehensive protection for secure, peaceful online shopping. Our policies proactively prevent cyber incidents, equipping you with tools and advice to stay ahead of cybercriminals.

Don’t let cyber threats deter your digital lifestyle. Choose Mitigata’s personal cyber insurance today and shop with confidence.