Cyber-attacks are not just a problem for large corporations. Small and Medium Enterprises (SMEs) are now increasingly attracting the attention of cyber criminals, who consider them easy targets. According to a Cisco report, Indian small and medium businesses (SMBs) experienced up to INR 7 crores of losses due to cyberattacks in the 2020-2021 span. These huge numbers reveal that there are a number of topical issues regarding security measures in cyberspace, especially cyber insurance.

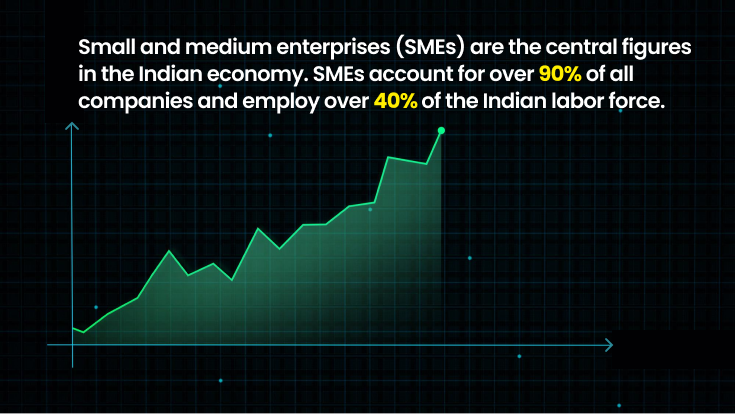

The Backbone of the Economy: SMEs in India

Small and medium enterprises (SMEs) are the central figures in the Indian economy. SMEs account for over 90% of all companies and employ over 40% of the Indian labor force. These companies encourage innovation and create jobs, which are severe indicators of GDP. However, the digital age brings new challenges alongside opportunities. As Small and Medium Enterprises (SMEs) continue adopting technology for improved process management and operational efficiency, they become increasingly vulnerable to cyberattacks.

The Growing Cyber Threat Landscape

Cybercriminals mainly target SMEs, which, due to their general lack of capacity in this field, are less inclined to invest in a robust security approach. This makes them easier targets compared to larger organizations.

According to the PWC Global Risk Survey 2023, 38% of Indian organizations are highly susceptible to cyber risks. As the number and sophistication of cyber-attacks grow, SMEs must implement a preventative approach to safeguarding digital assets.

The Role of Cyber Insurance

Cyber insurance is a vital tool in any company’s insurance arsenal that is willing to take the financial blow for a cyber attack gone wrong. It offers financial security from a range of cyber attacks, including data leaks, ransomware attacks, and business disruptions. For SMEs, this financial safety net can be the difference between recovery and closure after a cyberattack.

1. Financial Protection

Financial support is one of the most significant benefits of cyber insurance. Cyber incidents can lead to substantial costs, including legal fees, data recovery expenses, and potential fines. The cost for SMEs that are often doing low budget work is a killer. Cyber insurance has the potential to cover such costs, which can get businesses back on the road quicker and reduce the financial impact of cyber liability

2. Enhancing Cybersecurity Posture

Getting cyber insurance frequently involves meeting specific cybersecurity requirements. This may, however, require implementing measures such as Multi-Factor Authentication (MFA), planning of incident response procedures, and robust data protection policy. These requirements help enhance SMEs’ general cybersecurity situation, reducing their exposure to attacks.

3. Peace of Mind

To the peace of mind of small business owners is the feeling that they have a fallback plan in an emergency. Cyber insurance allows them “flex” to focus on company growth without the crippling fear of insolvency that cyber-attack can cause.

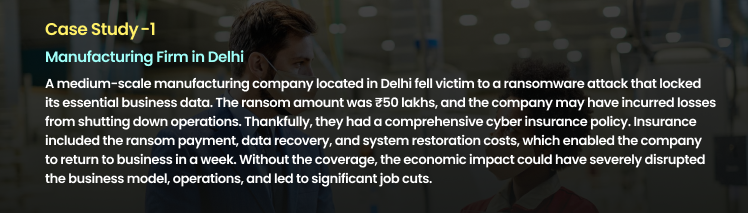

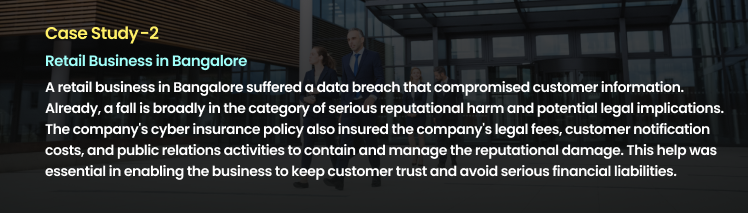

Case Studies: Real-Life Impacts of Cyber Insurance

The Importance of Choosing the Right Policy

SMEs must consider their tailored risks when buying a cyber insurance policy and being adequately insured. Not every business is exposed to the same kind of danger; consequently, policy must comply with this. Key considerations include:

Understanding Coverage and Exclusions

However, cyber insurance policies differ regarding the comprehensiveness of coverage or exclusion of certain coverages. Policy operators must take care when looking at this information to ensure that the policy is suitable to their needs. Typical coverage areas include:

- Data Breach Response: This covers compensation for data breach management costs, such as legal fees, notification costs, and credit monitoring services provided to affected clients.

- Business Interruption: This covers lost income and additional out-of-pocket expenses incurred during the recovery period after a cyber incident.

- Cyber Extortion: Includes ransomware ransom payments and associated expenses in the event of a ransomware attack.

- Third-Party Liability: Protects the company against legal actions from customers or other third parties caused by the cyber incident.

Evaluating the Insurer’s Reputation

The insurer’s stature, reputation, and expertise in cyber claims are critical. SMEs should choose carriers with a strong track record ensuring cyber and carriers who can supply the necessary knowledge and resources to handle a claim response when it comes.

Policy Limits and Deductibles

Understanding the policy limits and deductibles is essential. It is recommended that [SMEs] choose a policy with at least a high coverage limit to cover possible events and the ratio cost of deductibles.

Common Misconceptions About Cyber Insurance

“Cyber Insurance is Only for Large Corporations”

One of the most frequent errors is that cyber insurance is only for large enterprises. Nevertheless, SMEs are as, if not more, susceptible to cyber-attacks. The financial impact of a cyber attack can be catastrophic to a microenterprise, and therefore, cyber insurance is an integral component of the microenterprise risk management philosophy.

“Cyber Insurance is Too Expensive”

While cost may be an issue for smaller and medium enterprises (SMEs), the price of not having coverage for cyber liability might be higher. The financial protection and assistance provided by a cyber insurance policy may help businesses avoid a potentially catastrophic financial crisis.

Benefits of Cyber Insurance for SMEs

1. Improved Risk Management

Cyber insurance products typically offer access to tools and expertise that help SMEs develop a more robust overall cybersecurity posture. This might include:

- Cybersecurity Training: Courses/software for training workers on cyber attacks and security best practices.

- Incident Response Planning: Contribute to designing and implementing an effective incident response plan.

- Security Audits and Assessments: Regular assessments to identify and address vulnerabilities.

2. Financial Resilience

Cyber insurance can help SMEs raise financial resilience against cyber events. In other words, companies can absorb data breaches, ransomware attacks, and other cyber-ills, avoid the resulting financial backlash, and return to a restoration phase and profitability.

3. Legal and Regulatory Compliance

One of the most common provisions of cyber insurance policies is an allowance for ongoing legal and regulatory compliance support for SMEs, which is required to meet such standards and avoid potential fines and penalties.

The Role of Mitigata

With Mitigata, we observe how SMEs can potentially suffer from challenges in the modern web world. Our comprehensive cyber insurance solutions are designed to provide the financial protection and peace of mind that small business owners need. Using Mitigata, you can concentrate on expanding your business and be assured of being safeguarded against the constantly changing nature of cyber threats.

Call to Action: Protect your business today with Mitigata’s cyber insurance. Visit our website or contact us to learn how we can help ensure your future.

Ultimately, cyber insurance is becoming not an option but a necessity for SMEs. With the right policy intervention, small businesses may be made agile enough to face the tactics of the digital age, securing risk reduction along with enhanced growth.